Welcome !

Welcome to the end-of-year edition of the STS Newsletter by PCS, keeping stakeholders up to date about market and regulatory developments in the world of STS. In this edition we do not follow the usual pattern of our Newsletter but will instead look back at the year 2021, assess the current state of play and look towards 2022.

As with 2020, the year 2021 was a year of COVID-19 and the pandemic weighed, directly and indirectly, on all aspects of our lives.

STS securitisation was no exception, if only indirectly through the effects of yet another massive injection of pandemic related “helicopter money” from Frankfurt and Threadneedle Street.

As ever, we very much welcome any feedback on this Newsletter.

Market data – Looking back at 2021 – What the numbers tell us about STS

There can be no doubt that 2021 was a strange year with the unexpected lengthening of the COVID crisis and its increasingly erratic twists and turns as well as its puzzling, sometimes contradictory, but always difficult to read impact on the economy. In some senses, it was a good year for STS, in others, less so. We develop our broader analysis of the meaning of 2021 for the securitisation market as a whole in our later segment (“Hurrah for growth .… but is it enough ?”). Here, we focus on specific STS numbers. We also look at our predictions for 2022.

Please note that, differently from most year-end commentaries, we have focused on number of deals rather than volume of issuance. The reason for this is not that numbers have a greater explanatory power than volume but rather that they have a different and complementary explanatory power. Many research firms and other commentators provide the volume numbers and it seemed of limited value to just do the same. By focusing on numbers, PCS hopes to shed not a better light but a different light on the year.

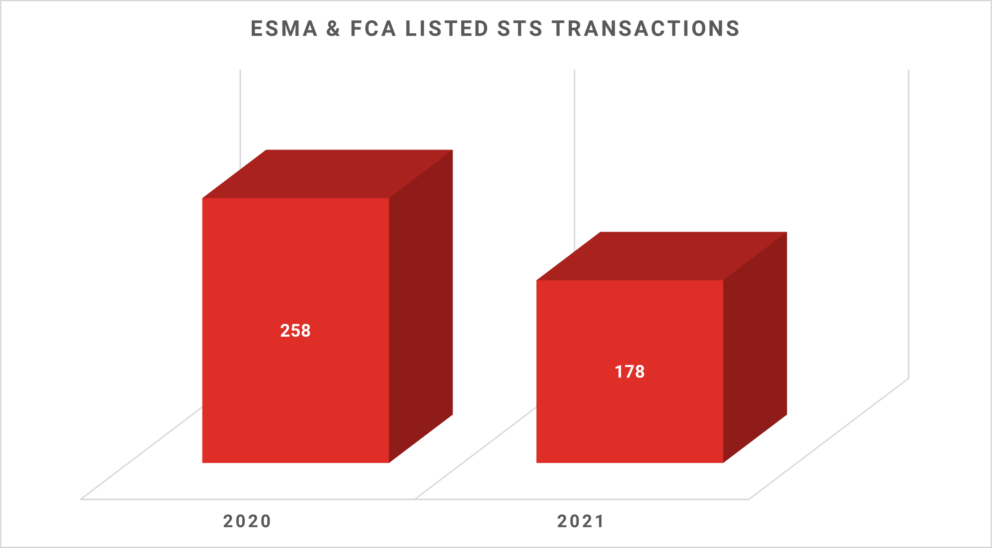

(All numbers are as of 10th December 2021 and so comparisons with 2020 are not exactly on the same basis. PCS only expects 4 to 5 additional STS deals by year end though. Also, 2020 EU numbers still contain UK transactions, so EU 2020 to 2021 comparisons need to factor in the departure of the UK. This is why we also give Europe wide – including the UK – figures to compare.)

The big picture

Numbers

Commentary

This headline decrease is highly misleading as it is entirely driven by the “mechanical” decrease in ABCP transactions being notified. We analyse this phenomenon below and would advise our readers simply to ignore this number. More importantly, the number of notified public deals went up from 70 to 81.

Unchanged from previous years, originators issuing in all asset classes that can achieve STS in a straightforward manner universally continue to do so when publicly placing paper in the markets. Last year, we had indicated that the only exception was “Buy-to-let” RMBS. Although this remains broadly true, 2021 saw three RMBS BTL transactions achieve STS, indicating that even this hold-out might be migrating to the STS camp.

As in 2020, 100 % of STS securitisations publicly placed with investors in 2021 elected to be verified by a third-party verification agent.

In addition to the traditional “true-sale” securitisations, as of April 2021 “synthetic” securitisations (also known as “on-balance-sheet” securitisations) have been able to achieve STS status in the EU (but not the UK). As of mid-December, 10 synthetic transactions had been listed with ESMA as STS.

Below the surface

Numbers…

| 2020 | 2021 | YoY | |

| Public | 70 | 81 | -16% |

| Private | 188 | 97 | -48% |

More numbers…

| 2020 | 2021 | YoY | |

| ABCP | 172 | 75 | -56% |

Commentary

The 16 % increase in publicly placed STS is welcome but must be understood in the context of a nearly 50 % increase (by volume) in European securitisation as a whole.

This year saw both a continuation and an acceleration of the trends that PCS identified in December 2020 (2020 – The STS Year in Review – Prime Collateralised Securities (pcsmarket.org)).

These trends include the continued ebbing of plain vanilla securisations originated by large banking institutions. We have long identified as the primary driver of bank STS volumes the competition presented by the various ultra-low rates lending windows made available by the ECB and the Bank of England. Anticipating the closure or narrowing of those windows, market participants – including PCS – were wrongfooted by the unexpected pandemic and central banks’ response. In the UK, whilst the TFS closed, the new TFSME was introduced and pumped almost £ 90 bn of liquidity into the banking system. In the EU also, the PELTRO took over from TLTRO 3.

So, behind the 16 % increase in public deals, 2021 saw the continuing substitution of traditional bank originators by new non-bank market participants. This was particularly noticeable in the UK where none of the large master-trusts issued at all and only three traditional building societies came to market.

The decrease both in absolute and relative terms of the number of private transactions should put paid to the concern expressed by some public bodies. There was suspicion aired in some quarters that the increase in private transactions was taking place at the detriment of public deals; in other words that transactions that would normally have been public were being executed in the private market possibly to avoid disclosure requirements. PCS already published on that matter last year, noting this was a misperception. No deals were migrating to the private sphere and the large number of private ABCP transactions reflected two facets specific to that segment of the market. In our 2020 end of year newsletter, we had explained that (a) multiple versions of the same deal appeared on the ESMA list thus making these transactions appear more numerous than they were and (b) almost all those deals were long-standing transactions rather than new financings, in other words “stock” rather than “flow”.

We therefore anticipated that 2021 would see fewer ABCP transactions than 2020 and that 2022 would show a very marked diminution in numbers as the old stock had been converted to STS and ongoing notifications would attach primarily to the much smaller flow of new transactions. That said, we had not anticipated that the numbers of STS ABCP transactions would drop quite as swiftly as they did in 2021. As a proportion of overall European STS transactions, ABCP transactions accounted for only 42 % in 2021 compared to 66 % a year earlier.

ABCP transactions accounted for only 42 % in 2021 compared to 66 % a year earlier.

Asset classes

| Public Transactions | 2020 | 2021 | YoY |

| RMBS | 25 | 23 | stable |

| Auto | 26 | 27 | +42% |

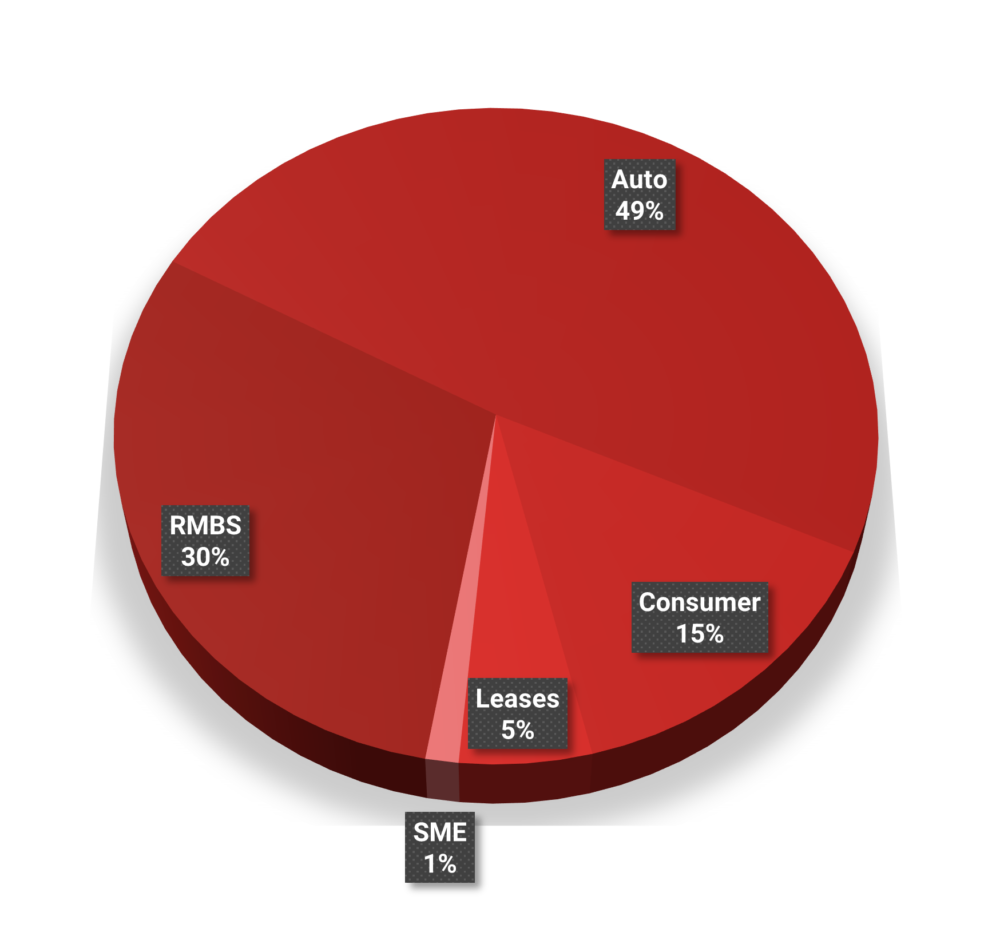

Public EU & UK 10-12-2021 YTD

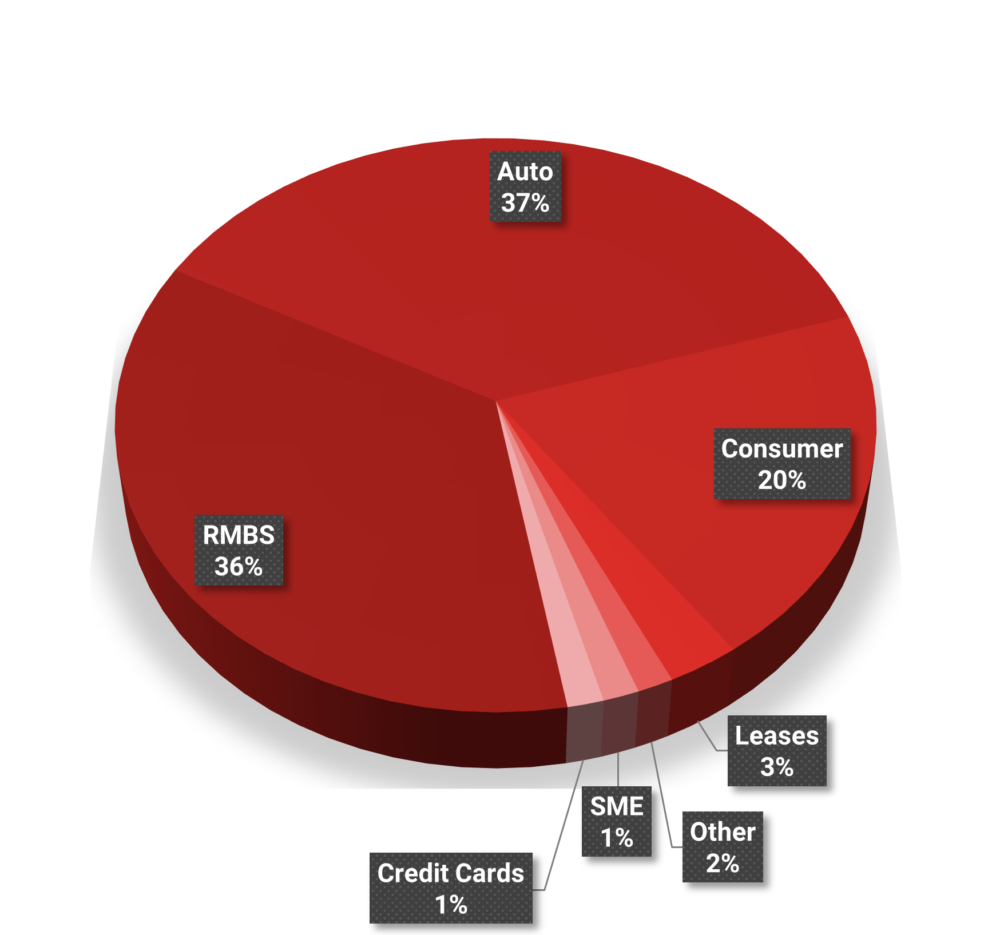

Public EU & UK Full Year 2020

Commentary

The growth story in 2021 from an asset class point of view is the auto sector which went form 26 in 2020 to 37 this year making it, in number of deals, the largest STS asset class.

This was at the expense of RMBS which remained stable (losing just two transactions from 25 to 23). In addition to RMBS’ relative decline this year against the auto sector, one should also note that 2021’s 23 transactions stand against 49 transactions in 2019. This comparison is made starker by the fact that, for a variety of technical reasons, STS transactions in 2019 only began in March of that year. RMBS’ 2021 year on year stability is resting on a historically extremely low base.

Two interesting figures in the auto sector are also worth mentioning.

First, without a real “non-conforming” auto sector, 100 % of EU publicly placed auto transactions were STS. That was only 94 % in Europe as a whole reflecting the possible growth of a near prime/non-conforming auto securitisation market. How this interacts in the coming years with the STS market will be worth keeping an eye on.

Secondly, for the first time, securitisations by non-captives were issued in a larger amount than transactions for lenders connected to manufacturers. Again, whether this only reflects 2021’s low sales numbers for new cars and a temporary growth in the secondhand car market or is indicative of broader changes to auto finance will be interesting to see.

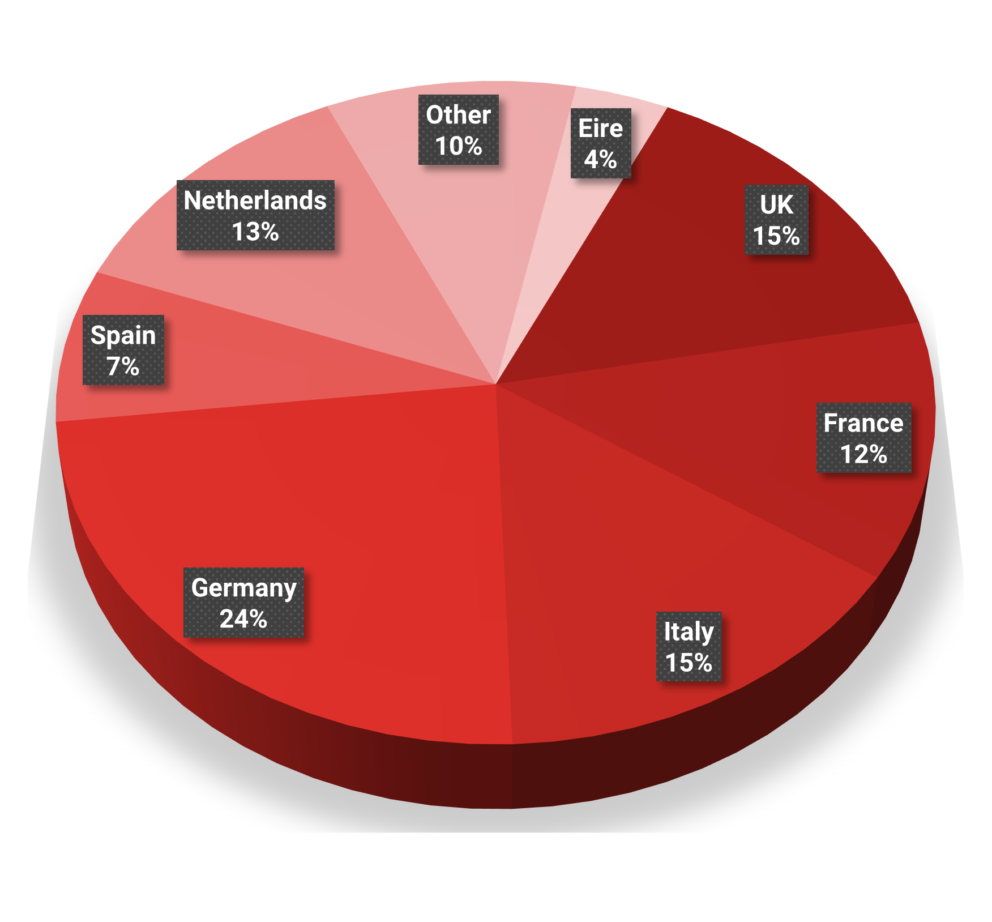

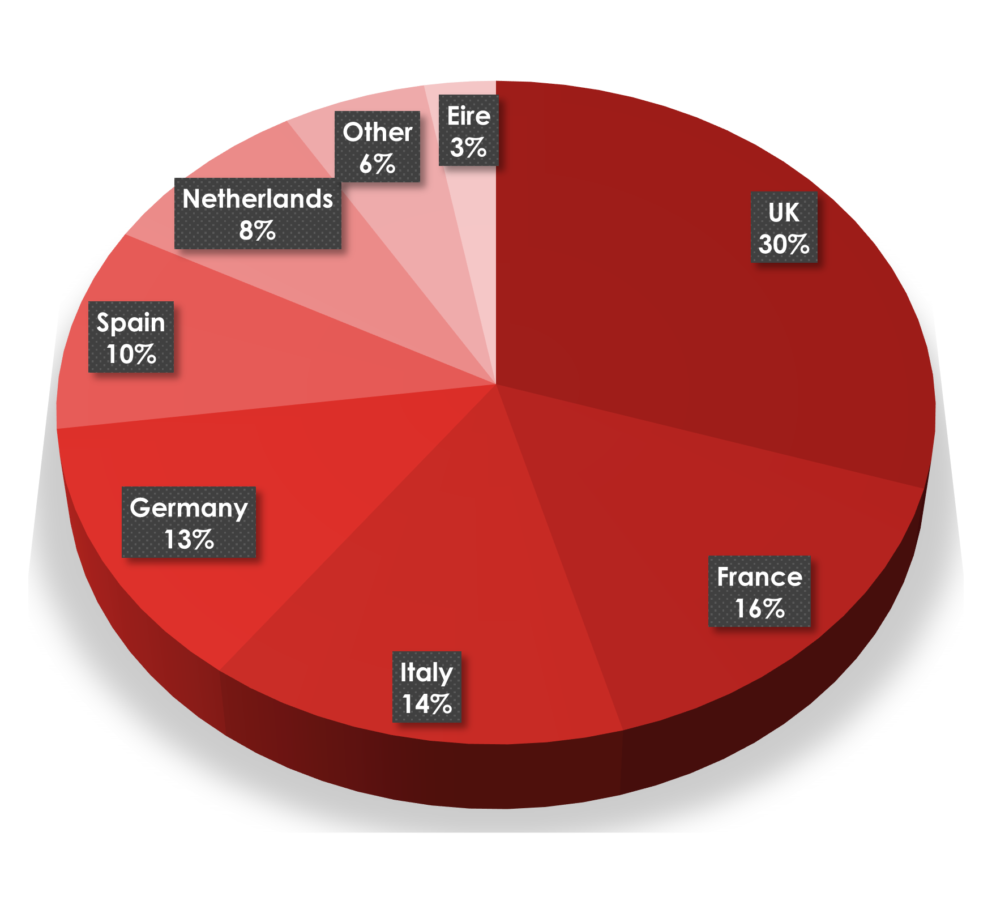

Jurisdictions

2021

2020

Commentary

The jurisdictional story follows broadly the asset class story. This year saw the UK and Germany trading places as the largest STS market. With the growth of the auto sector – closely associated to Germany – and the shrinking of the RMBS STS issuance in the UK (where 11 fewer RMBS STS transactions were closed than last year), Germany emerged as the largest issuing country, going from 12 % of issuance in 2020 to 23 % in 2021. Conversely, the UK went from a 30 % market share in 2020 to half that in 2021 (15 %). Other countries broadly maintained their relative percentages.

Synthetics/on-balance-sheet transactions

Synthetic transactions became eligible for STS on 9th April 2021. Since then, 10 transactions have been notified. As they are private, no information can be gleaned from ESMAs website as to asset classes, jurisdictions or whether they use third-party verification agents. PCS has received a number of mandates for STS synthetic transactions, some of which have been completed and are included in those notified to ESMA.

General Market Commentary

In last year’s end-of-year newsletter we indicated that, in the auto sector at least, by the end of the year, spreads had retraced their path to pre-COVID levels. This was a strong indicator that low 2020 issuance was due to supply constraints and not lack of investor appetite.

By the end of 2021 and not just in the auto sector, many spreads had retraced their path to pre-Great Financial Crisis levels. We saw a couple of German auto transactions print at 10 bps and, in the secondary market, prime Dutch RMBS trade as low as 9 bps (for AAA’s). At one point, in the summer, German autos traded down to 4 bps in the secondary and still are finishing the year at around 5 bps.

Throughout the year, across all jurisdictions and all asset classes, we saw spreads slowly but relentlessly grind down both in the primary and secondary until about a month ago when we saw a minuscule uptick.

So, in 2021 just as in 2020, lack of supply, not demand is the constraining factor in the STS securitisation market.

Predictions

Predicting markets at the best of times is somewhat of a foolish endeavour. Today, with uncertainty over a global pandemic hanging over everything, it is truly quixotic.

That said, last year PCS predicted that the public STS market would grow YoY by 15 % and today we see that it has grown by…. 16 %. So, let us see if we can be lucky twice.

At a global level, the macro story of 2021 is the potential return of higher, non-transient inflation. For the securitisation market, inflation is usually a good thing. European securitisation is a floating rate market in a broadly fixed rate capital market. If investors become concerned that inflation will drive up rates, floating rate products become more attractive. But we have already seen that the low level of STS public issuance is not driven by low investor appetite but by lack of supply. So, if concern over possible inflation merely raises investor demand even further, this will not necessarily transfer into higher volumes of issuance. Higher investor interest can, of course, lead to tighter spreads making issuing more attractive. But, first, spreads are already so low that it is hard to see how much further they could travel. Secondly, however far they travel, they will still not likely compete with central bank cash.

On the other hand, we continue to see extremely accommodative monetary policy as a key to disincentivizing large bank issuers, particularly the availability of near-free cash provided by central banks. Therefore, the impact of inflation on the STS market will be mediated by central bank action and specifically by whether central banks reduce the flow of cheap liquidity to the banking system.

So, what will the Bank of England and the ECB do? Both find themselves between Charybdis and Scylla (or, if you are more transatlantically minded, a rock and a hard place): on the one hand, the monster of uncontrollable inflation, on the other, the dragon of omicron and a fifth wave. Currently, the Bank of England has leant toward a more hawkish discourse with the ECB seemingly indicating that no meaningful action would be considered until well into 2022. What will that translate into remains, however, obscure.

We suspect therefore that 2022 will see a cautious return of UK bank issuers in RMBS wanting to ensure that if the BoE acts, they will be ready.

We also see a continued but small growth of non-bank lenders across the European space as part of a longer term trend.

In autos, a resumption of economic activity should see a growth of new car sales which could drive some growth in issuance by captives. That, though, is predicated on a strong return to growth and so dependent, once again, on the trajectory of the pandemic.

With the implementation of Basel 3 (in 2023 in the UK – and, apparently, The Netherlands – and 2025 in the rest of the EU), banks have also focused more resolutely on internal capital allocation. So we have seen more bank lending facilities such as warehouses seek STS. This, PCS believes, will continue in 2022.

So, PCS anticipates 2022 being better for the STS market than 2021.

However, with the large macro-drivers likely to remain relatively unchanged – especially in the EU – we do not anticipate any radical transformation. We think growth of 10 % to 15 % in STS issuance is a reasonable expectation.

In addition, we anticipate around 25 to 30 synthetic transactions.

Hurrah for growth …. but is it enough ?

“Pessimism

A philosophy forced upon the convictions of the observer by the disheartening prevalence of the optimist with his scarecrow hope and his unsightly smile.” (Ambrose Bierce)

We, at PCS, are usually optimists although we believe of the realist school. But, noting around us the sound of popping corks and congratulatory hurrahs, we felt moved to sound a possibly jarring note of caution.

Yes, Europe saw its largest placed yearly market since the GFC

Yes, 2021 saw more than 50 % growth over last year.

Yes, new issuers came to market.

And yet, yet ….

Some numbers

Counting securitisations has always been more of an art than a science, dependent on fluid nomenclature, differing data bases and uncertain categorisations. For this analysis, we have used numbers from a single reputable house to keep things consistent. But if your chosen numbers do not exactly align with those here, do not panic. Neither of us is right or wrong, just counting in a slightly different way. But, aside from the exact numbers, the broad thrust from all the research houses as well as our own data, is consistent.

Placed securitisation in Europe (including the UK) in 2021 will stand at around € 124 bn. This compares to € 80 bn in 2020 and € 95 bn in 2019. This is a growth of 56 % over last year (admittedly a miserable vintage) and 31 % over two years ago.

RMBS grew 27 % over last year. Auto issuance grew less but still grew from € 16.7 bn to € 19 bn (13 %).

CMBS went from € 2.4 bn to a spectacular € 7.2 bn – a tripling in a single year. (+ 200 %) – and CDO’s nearly doubled to € 43 bn.

And, notwithstanding this sudden increase in volume, spreads not only returned in many asset classes to pre-COVID levels but in some cases to pre-GFC levels (see our Market Data section).

This growth had been predicted by no-one – including PCS.

What is there not to like?

The diminution of ambition

PCS was set up in 2012 to assist in supporting a return to a deep, liquid, simple and safe securitisation market that would play a key role in the European financial architecture. A market that would allow European banks to manage pro-actively their capital in a Basel III environment as well as be a major source of funding. A market that would provide European investors and particularly insurance companies and pension funds a deep pool of AAA/AA assets with a fair return allowing them to move away from sovereign debt without sliding too far down the credit curve.

When such a market was discussed, comparisons with the United States were common and this renascent European market was supposed to be the foundation of a new Capital Market Union within the EU (then containing the UK) reversing the continent’s dependance on the banking sector for 75 % of all financings (compared to 25 % in the US).

It is with this ambition that policy makers and market participants discussed regulatory changes and legislative initiatives. It is for this ambition that the STS regime and the Securitisation Regulation was passed.

To see how this compares to the US, we invite you to read our article (“The indispensable reform”).

The market the securitisation community once aimed at involved annual issuance volumes in Europe of around € 400 bn – € 500 bn. PCS has calculated that the smallest market volumes consistent with securitisation playing a meaningful role is € 265 bn per annum.

When the Securitisation Regulation was passed, the European Commission suggested it would result in € 100 bn of additional issuance. Many criticized it at the time for “low-balling” its ambitions. Today, after a banner year and three years after the entry into force of that regulation we have achieved € 30 bn of additional issuance over 2019.

This year was a good year for European securitisation. But it is a year that still leaves European issuance € 70 bn below the Commission’s low target, € 150 bn below the minimum necessary for securitisation to play a meaningful role and € 275 bn to € 375 bn below the level at which securitisation plays the same role in Europe as it does in the US.

And we still see no sign of new investors, particularly from the insurance and pension fund areas.

We believe that it is fine to celebrate the achievements of 2021 but let us not become so used to securitisation bumping along the bottom that we lose sight of how much still needs to be done and how far we are from where both the private and public sectors have said we need to be.

Is it the right kind of growth?

The securitisation market discussed above and anticipated by policy makers was a deep market the backbone of which was plain vanilla, simple and transparent issuance in the traditional asset classes at fairly low spreads for risk averse investors with a range of more complex and exotic products with higher spread for sophisticated investors.

To reach € 124 bn, the market grew in 2021 by € 44 bn. This involved a € 7 bn decrease in corporate securitisations. So those areas that grew, grew by € 51 bn.

Of that growth:

- € 12 bn was “buy-to-let” mortgage RMBS

- € 21 bn was CLO/CDOs

- € 4.8 bn was CMBS

Those three categories accounted for around € 38 bn of the € 51 bn growth (75 %).

Broadly, ABS accounted for the rest.

In RMBS, prime RMBS accounted for € 9.3 bn of the issuance. This is a decrease from 2020.

Non-prime and BTL RMBS accounted for € 26.2 bn. In other words, the plain vanilla classic product of STS in 2021 accounted for a quarter of its own asset class and 7.5 % of overall securitisation issuance.

In 2021, for the first time ever, CLO’s/CDO’s – a sophisticated managed product that cannot achieve STS status – became the largest asset class and not by a small margin.

We are not suggesting that CLO’s/CDO’s, CMBS or BTL RMBS are not legitimate asset classes or solid securitisation products. But they are not simple and, in the case of the first two, have idiosyncratic risks that make them more difficult to analyse. This was extensively discussed in PCS’ 2013 white paper and the EBA’s original report out of which STS grew and explains their exclusion from the STS standard.

What is clear, is that they cannot be the core of a growing simple market such as envisaged by policy makers or as needed by Europe.

So, as much as we can celebrate their growth and the contribution to the overall growth of securitisation in Europe, this is not a growth that appears to be taking Europe (including the UK) in the direction that we had collectively set for ourselves.

2022, the year that builds 2023 and beyond

The calendar for 2022, when it comes to securitisation, may appear very light. This section will go through the key changes that will impact the market and we will see that few, if any, will or are likely to be finalized next year. From today’s vantage point, 2023 looks like the year in which many of these key changes will land.

But if the events calendar looks light, the worksheet for 2022 is very heavy indeed. This is because the discussions, arguments, data gathering and conversations that will shape the outcome of those events will be taking place next year. For example, PCS has argued passionately that securitisation must find a workable and equitable place within a sustainable finance regime. Next year will see the debates in the European Parliament around the EU Green Bond Standard legislation as well as around the EBA report on a possible sustainable securitisation framework. Those with an interest in securitisation will have to make their case in 2022 if we hope to land a fair outcome in 2023

Looking at some of the issues that will be shaped by 2022 debates and will in turn shape the future of European securitisation (both in the EU and the UK), we highlight the following.

Calibration issues

From before the passage in 2017 of the Securitisation Regulation, many stakeholders in the securitisation market, including PCS, have argued that the capital requirements for banks and insurance companies holding STS securitsations was neither reflective of the real risk of those instruments nor fair or accurate when compared to the requirements for other capital market products. Rectifying those incorrect calibrations will require modifications to the Capital Requirements Regulation (the CRR) and Solvency II respectively – and, since the beginning of this year, their onshored versions in the UK.

In addition, many have pointed out that the limitations on the inclusion of STS securitisations in banks’ liquidity coverage ratio pools (LCR pools) are inconsistent with their liquidity performance.

Improving capital requirements for bank investors under the CRR, for insurance investors under Solvency II and eligibility for inclusion in LCR pools, both in the EU and the UK, are what we refer to as the “calibration issues”.

The Commission decided finally to move forward with a re-examination of the calibration issues. Last October it tasked the Joint-Committee of the ESAs to provide their views with the possibility of amending the laws. The Joint-Committee though has until September 2022 to report. This means that, in the best-case scenario, no draft legislation should be expected from the Commission until well into 2023. But if we wish to see a positive outcome, stakeholders will need to make their voice heard in 2022.

Whether a similar re-examination can be expected in the UK looks fairly unlikely at this stage, following the publication yesterday of HM Treasury’s report on the review of the securitisation regime (see our news item). On the calibration issues, as well as on the possible inclusion of synthetic securitisations in the STS regime, the newly published report makes for very dispiriting reading even if the door is not quite entirely closed and locked shut.

Green Securitisation

In the EU, two strands that will define the possibility of green securitisations and whether it can find a place within a new sustainable finance environment will interweave in 2022 in ways that are not entirely clear.

First, the EU Commission has placed draft legislation on the EU Green Bond Standard (EU GBS) before the Council and Parliament. It is difficult to gauge when this draft legislation will be voted on as the urgency of dealing with climate change in the EU is balanced by the controversial nature of many topics which slows down legislative action. But even if the EU GBS were to be passed in 2022, it is unlikely to be fully functional until technical standards are published. So, the impact of this legislation will hit most likely in 2023. But 2022 will be the year when key decisions will need to be taken about what green securitisation will look like – decisions which will determine whether securitisation can play an important role in financing the transition to a sustainable economy or whether it is sidelined by too restrictive a definition or too onerous a set of requirements compared to other instruments.

Secondly, the EBA is meant to report back to the Commission on their views as to what a sustainable securitisation framework would look like. The fact that the EU GBS and the EBA report are part of two separate processes with non-synchronised calendars is something about which PCS has expressed concern. It raises the specter of a green securitisation regime that is not part of the normal green bond regime but is somehow bespoke. Such a separate regime with different rules, different disclosure burdens, different due diligence requirements would likely lead to green investors turning away from securitisation as a green funding tool if it required a totally different approach and set of compliance rules. A key goal of stakeholders in the securitisation market in 2022, including PCS, is to ensure that the sustainability regime for securitisation is properly incorporated in the overall capital market regime in a sensible way.

After the recent delay from 2022 to 2023 to the full implementation of the Sustainable Finance Disclosure Regulation (SFDR) which also applies to asset managers purchasing securitisations, 2022 will also be the year in which the securitisation industry (issuers and investors) has to work out what disclosure must and can be made to satisfy legal requirements. This promises to be complex work (hence the, in retrospect, inevitable delay).

In the UK, there is currently no public proposal for a UK GBS and no UK taxonomy on which it could be grounded. However, the UK Treasury has indicated that it hopes to have a taxonomy published by the end of 2022. Also, although SFDR does not apply to the UK, a similar disclosure regime has been announced for 2022.

SRT and final Basel III implementation

As of 2023 in the UK (and, it would appear, by request of the DNB, in The Netherlands) and as of 2025 in the rest of the EU, banks will be subject to the full Basel III requirements. These will include the output floors which are likely to raise capital requirements on most banks, in some cases quite considerably.

At the same time, one of the key features of securitisations is its capacity to remove risk from banks’ balance-sheets by transferring assets to a securitisation (whether via a “true-sale” or a synthetic transaction). So, securitisation can ease the burden imposed by additional capital requirements by reducing the risk against which that capital is required. To do so, the securitisation must meet the standards set out by regulators for “significant risk transfer” (SRT)

Basel III’s final implementation is proving highly controversial in Europe and 2022 is shaping up to be a year of many difficult public arguments over numerous technical aspects of the output floors.

Output floors are not a “securitisation issue”. Yet, the interaction between the SRT rules that are supposed to be finalized in 2022 and the technical workings of the output floors will have a potentially enormous impact on the feasibility and value of many “true sale” and synthetic securitisations.

This is not the place to take our readers through the complex issues raised by these proposals, but there is no doubt in PCS’ mind that unless the securitisation community chooses to be part of this debate in 2022, the impacts on our markets will be overlooked and by 2023 a set of decisions may have been taken with deeply negative impacts on parts or all of the securitisation markets.

Monetary Policy

Another key development in 2022 will be the actions of central banks. If inflation fears lead to a reduction in cheap bank liquidity provided by central banks, then securitisation is likely to return and possibly quite strongly.

This is, of course, more in the nature of a watching brief as neither the ECB nor the Bank of England are likely to factor securitisation issuance as a key element of decision making around monetary policy. But in 2022, and for the first time in many years, the direction of travel for central bank policy, torn between inflationary risks and COVID economic recovery needs, is genuinely uncertain.

Again, the result of discussions in 2022, albeit not on securitisation per se, will likely have a major impact on the market in 2023 and beyond.

In conclusion, although nothing very dramatic is scheduled to occur in 2022, this will be both a very busy and important year for the market. When it comes to policy making, it is likely to be the busiest and most important year since 2017 when the final amendments to the Securitisation Regulation were being negotiated.

Best Wishes for 2022

In this Newsletter, we want to take the opportunity to thank our readers and other stakeholders for the co-operation in 2021 and convey our best wishes for the new year.

So, from London, Paris, Milan, Munich, Poznan, Amsterdam and Banholt, the Outreach Team and Analytical Team from PCS send you Season’s greetings and wish you a happy, prosperous and, above all, healthy 2022.