The PCS

Initiative

The PCS Initiative was set up in 2012 by participants in the securitisation markets with strong support from the public sector, following the global financial crisis. The aim of the Initiative was to help define the type of safe securitisation products that could ensure a healthy financial flow of credit to the real economy without creating systemic risks for the European financial system and, in this way, assist in reviving the European securitisation market on a safe and sound basis.

Operating as a not-for-profit body, PCS provided labels to those securitisations that met strict standards of quality and transparency. Then, with the entry into force in 2019 of the Securitisation Regulation, PCS - whilst maintaining its not-for-profit status - became a third-party verification agent authorised both in France and the United Kingdom to verify STS securitisations across Europe.

From its inception, PCS also worked with European banks, finance companies, investors, trade bodies, regulatory authorities and policy makers to help shape a legal and regulatory environment that recognises the benefits that simple, transparent and standardised securitisations can bring to the European economy without sacrificing the overriding requirement of systemic stability.

The PCS Group

PCS is an independent initiative. It is not an industry body, an industry association or a trade association. PCS does not take instructions from any industry entity or group of entities. The views expressed by PCS are its own and do not represent the views or opinions of any other entity, including the members or observers of the PCS Association.

PCS is also a not-for-profit body. All revenue generated by its activities are used to meet costs and re-invested in the Initiative.

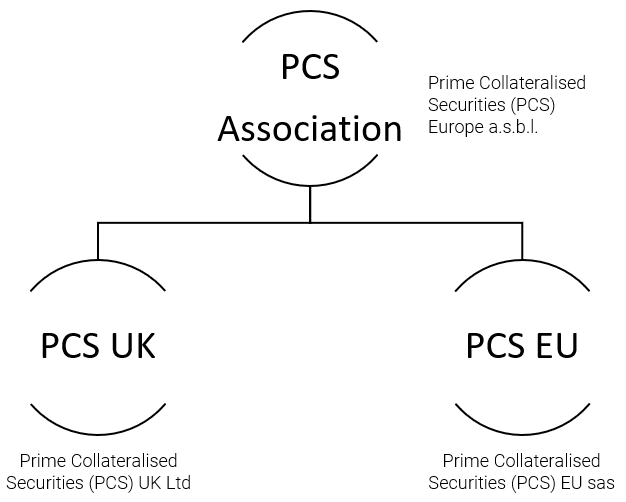

PCS UK and PCS EU are fully owned subsidiaries of PCS Europe, a Belgian not-for-profit association.

PCS Association Members:

- A&O Shearman

- Allianz

- Alpha Bank

- Amundi

- APG

- Ashurst LLP

- Attica Bank

- AXA

- Baker & McKenzie

- Banca Sella Holding S.p.A.

- Barclays

- BBVA

- Bishopsfield Capital Partners

- Bloomberg

- BNP Paribas

- BNY

- Clifford Chance

- Credit Suisse

- Deutsche Bank

- DLA Piper

- Eurobank

- European Banking Federation

- Freshfields Bruckhaus Deringer

- Hengeler Mueller

- Hogan Lovells International LLP

- ING

- Intesa San Paolo

- J.P.Morgan Asset Management

- Linklaters

- Lloyds Banking Group

- Mayer Brown

- Moody’s Analytics UK Ltd

- Morgan Lewis

- National Bank of Greece

- Nationwide Building Society

- NatWest Markets Plc

- NIBC Bank

- NN Investment Partners

- Obvion

- Piraeus Bank

- Rabobank

- Robeco

- Santander

- Securitisation Services S.p.A.

- Societe Generale

- Swiss Re

- TwentyFour Asset Management

- UBS

- UniCredit

- Vieira De Almeida

- Vinge

- Waselius

- Weil, Gotshal & Manges

Permanent observers are not members of the PCS Association and do not vote on PCS decisions and, as such, have no responsibility for any decisions of the PCS Initiative. However, they may – if they wish – attend all the PCS Association meetings and receive all the same information and documentation members receive.

- Association for Financial Markets in Europe (AFME)

- Dutch Securitisation Association (DSA)

- Eurofinas

- European Bank for Reconstruction and Development (EBRD)

- European Banking Authority (EBA)

- European Central Bank (ECB)

- European Fund and Asset Management Association (EFAMA)

- European Financial Services Round Table (EFR)

- European Investment Bank (EIB)

- European Investment Fund (EIF)

- European Securities and Markets Authority (ESMA)

- Hellenic Financial Stability Fund (HFSF)

- Insurance Europe

- International Association of Credit Portfolio Managers (IACPM)

- International Capital Market Association (ICMA)

- Irish Debt Securities Association (IDSA)

- KfW

- Leaseurope

Membership and observer status remain open and should you wish to join the PCS Association as either the former or the latter, please contact us.

Board Members

Market Committee

Our Team Members

Ian Bell

Mark Lewis

Tris Lateward

Rob Koning

Harry Noutsos

Anna Wozniakowska-Debiec

Fazel Ahmed

Robert Leach

Martina Spaeth

Daniele Vella

Lauren Sheppard