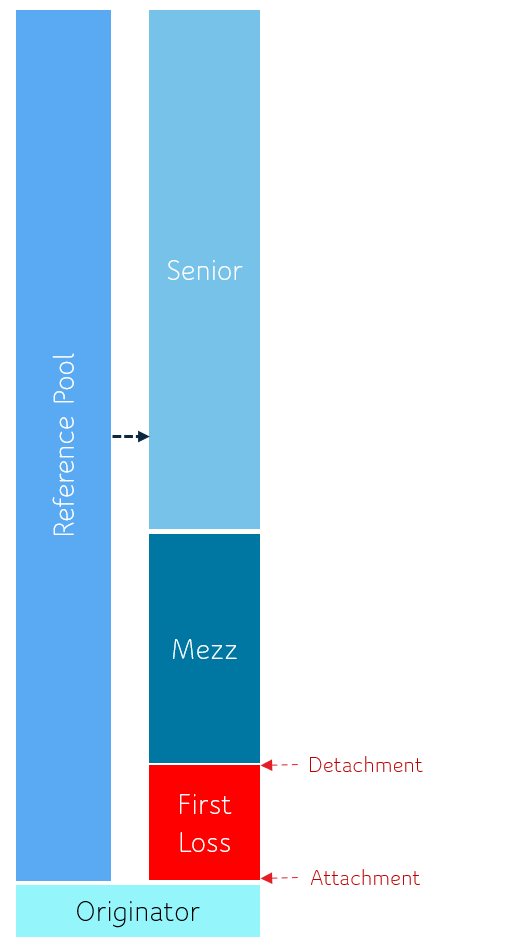

in a synthetic securitisation, the protection buyer will not seek protection against 100% of all losses on a reference pool.

This would be too expensive. So, the protection buyer and protection seller will agree that a certain amount of losses up to a given number will not trigger an obligation on the protection seller to make a payment. That number is the attachment point.

They will then agree that, once the losses on the reference pool have reached a certain maximum number, the obligations of the protection seller to make payments will cease. That number is the detachment point. So, the maximum amount that can ever be paid by a protection seller to a protection buyer under a synthetic securitisation is the numerical difference between the attachment point and the detachment point.

For example, Bank X enters into a synthetic securitisation with Investor A to purchase protection on a reference pool of €1 billion with an attachment point of €50 million and a detachment point of €250 million. If defaults occur on the reference pool, up to €50 million, Investor A does not make any payment. As soon as defaults reach €50,000,001, Investor A is required to pay €1 to Bank X.

Investor A then must compensate Bank X for all losses thereafter until losses reach €250 million. From then on, no payments need be made by Investor A for any additional losses.

The maximum amount payable by Investor A under the securitisation is therefore €250 million (the detachment point) minus €50 million (the attachment point) equal € 200 million.

It should be noted that there is nothing preventing the attachment point being set at zero.

In that case, the protection seller will have to pay as soon as any loss occurs on the reference pool and is said to hold a first loss position.

Created by Proformat