The PCS Initiative was set up in 2012 by participants in the securitisation markets with strong support from the public sector, following the global financial crisis. The aim of the Initiative was to help define the type of safe securitisation products that could ensure a healthy financial flow of credit to the real economy without creating systemic risks for the European financial system and, in this way, assist in reviving the European securitisation market on a safe and sound basis.

Operating as a not-for-profit body, PCS provided labels to those securitisations that met strict standards of quality and transparency. Then, with the entry into force in 2019 of the Securitisation Regulation, PCS - whilst maintaining its not-for-profit status - became a third-party verification agent authorised both in France and the United Kingdom to verify STS securitisations across Europe.

From its inception, PCS also worked with European banks, finance companies, investors, trade bodies, regulatory authorities and policy makers to help shape a legal and regulatory environment that recognises the benefits that simple, transparent and standardised securitisations can bring to the European economy without sacrificing the overriding requirement of systemic stability.

PCS is also a not-for-profit body. All revenue generated by its activities are used to meet costs and re-invested in the Initiative.

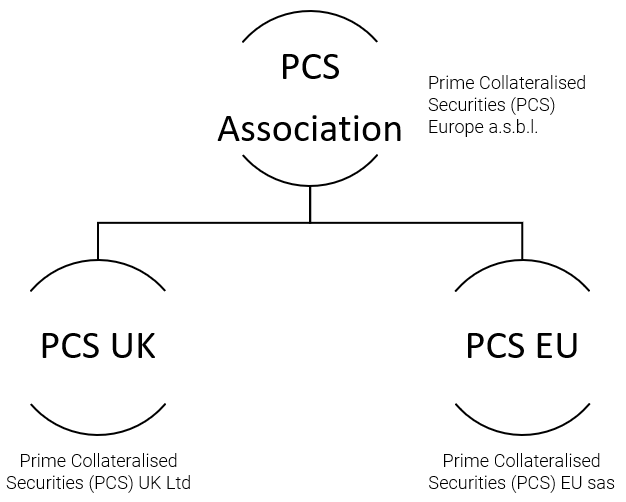

PCS UK and PCS EU are fully owned subsidiaries of PCS Europe, a Belgian not-for-profit association.

Permanent observers are not members of the PCS Association and do not vote on PCS decisions and, as such, have no responsibility for any decisions of the PCS Initiative. However, they may – if they wish – attend all the PCS Association meetings and receive all the same information and documentation members receive.

Membership and observer status remain open and should you wish to join the PCS Association as either the former or the latter, please contact us.

Created by Proformat