Welcome !

Welcome to this edition of the STS Newsletter by PCS, keeping stakeholders up to date about market and regulatory developments in the world of STS.

On May 17th, 2021, the Joint Committee of the European Supervisory Authorities (EBA, ESMA and EIOPA) issued its report on the regulation of European securitisation.

When we announced this publication in our News section we indicated that, subject to a more in-depth analysis, we felt the Report to be a substantial missed opportunity.

In this edition of our Newsletter, we provide the promised deeper analysis.

In our regular features, we share updated data on the STS securitisation market, discuss interpretation issues regarding Article 21.9 and present Rob Leach, Member of our Analytical Team.

As ever, we very much welcome any feedback on this Newsletter.

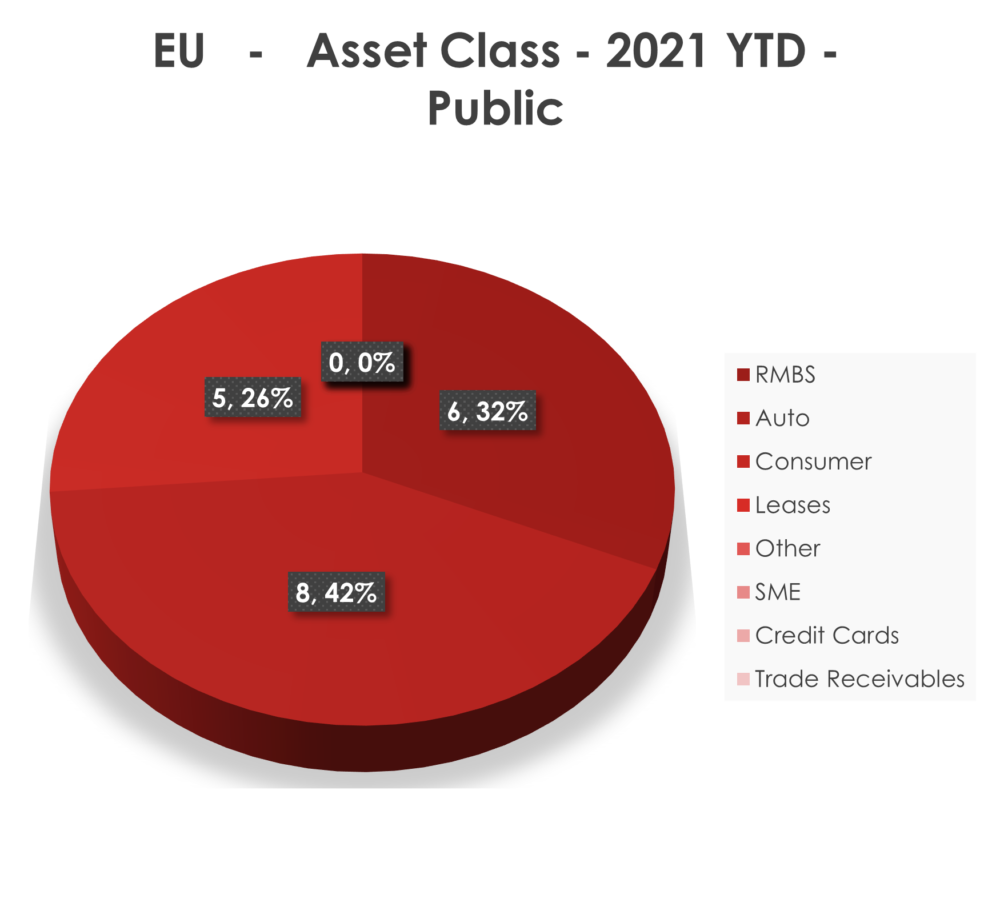

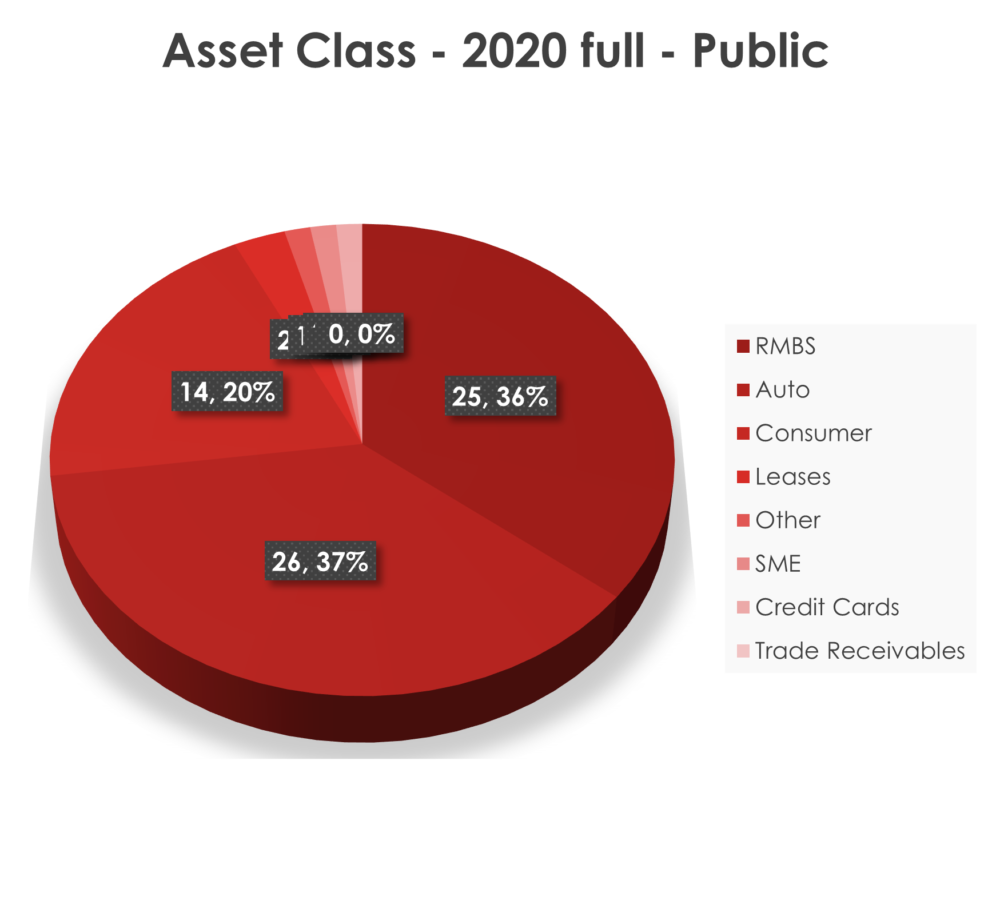

Market data

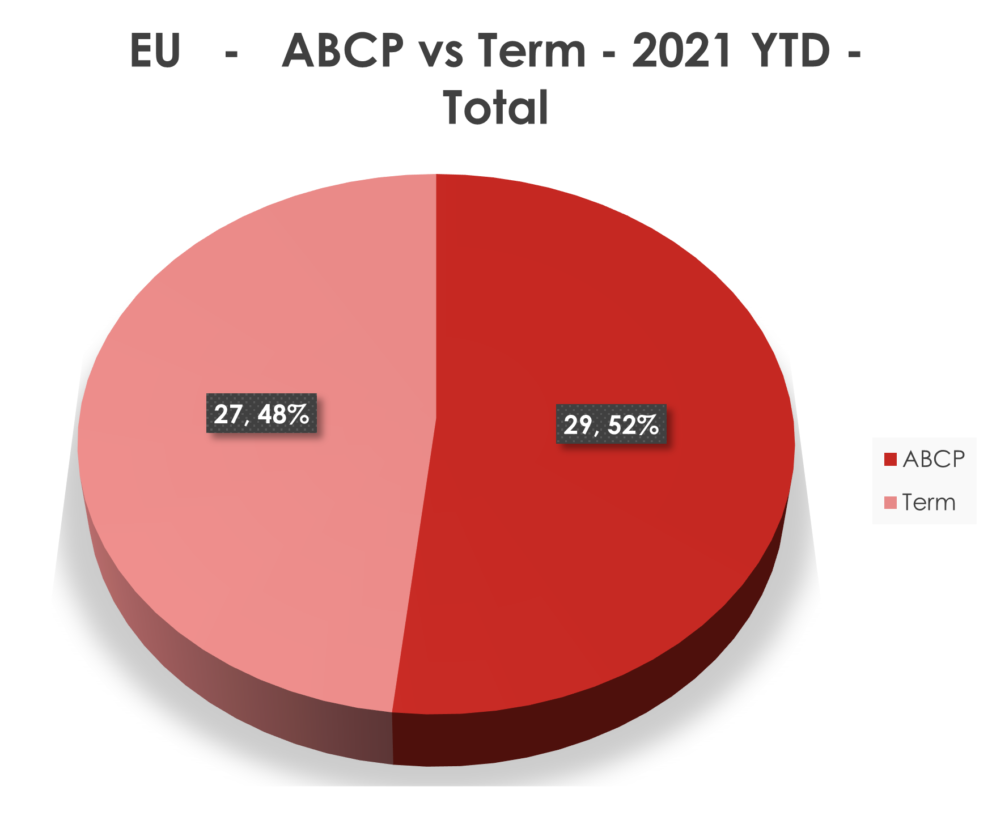

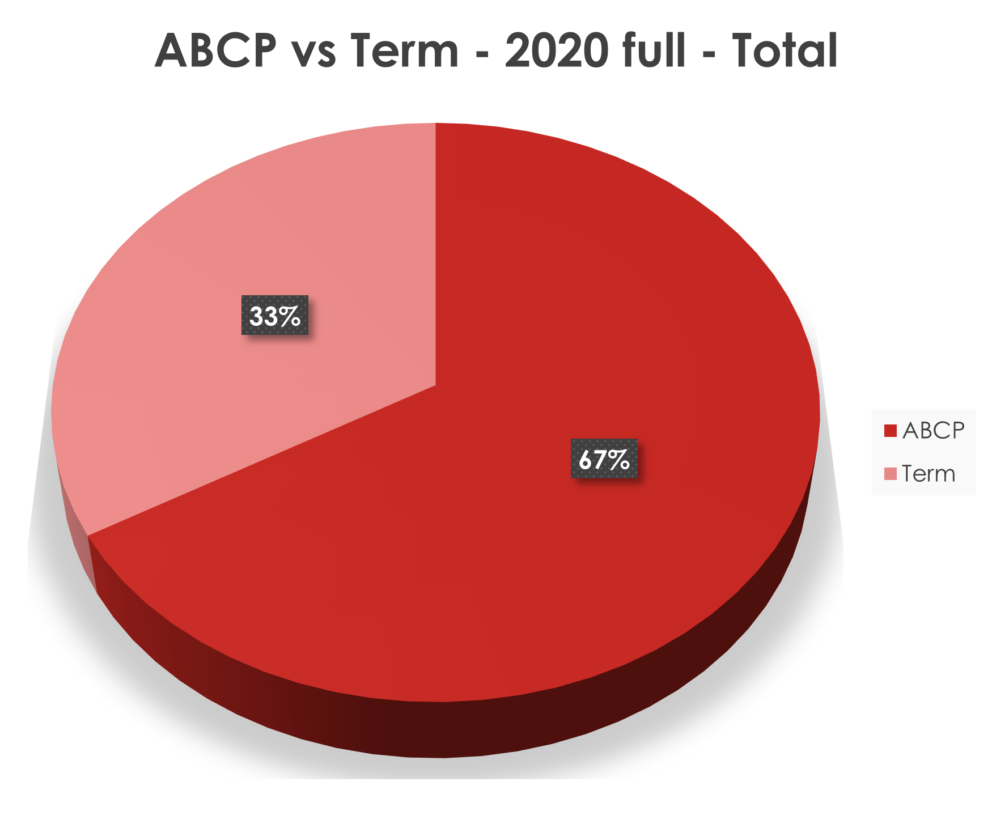

- As of 1st June, 2021 only 56 transactions had been listed on ESMA’s website as STS. To this, one needs to add the 9 transactions listed in the UK for a total of 65 year-to-date. Compare this to the full year number of 300 for 2020. Traditionally, more deals are completed in 2H than 1H. But even accounting for this, STS issuance looks to fall this year. This is worth keeping in mind when reading our piece on the ESAs report.

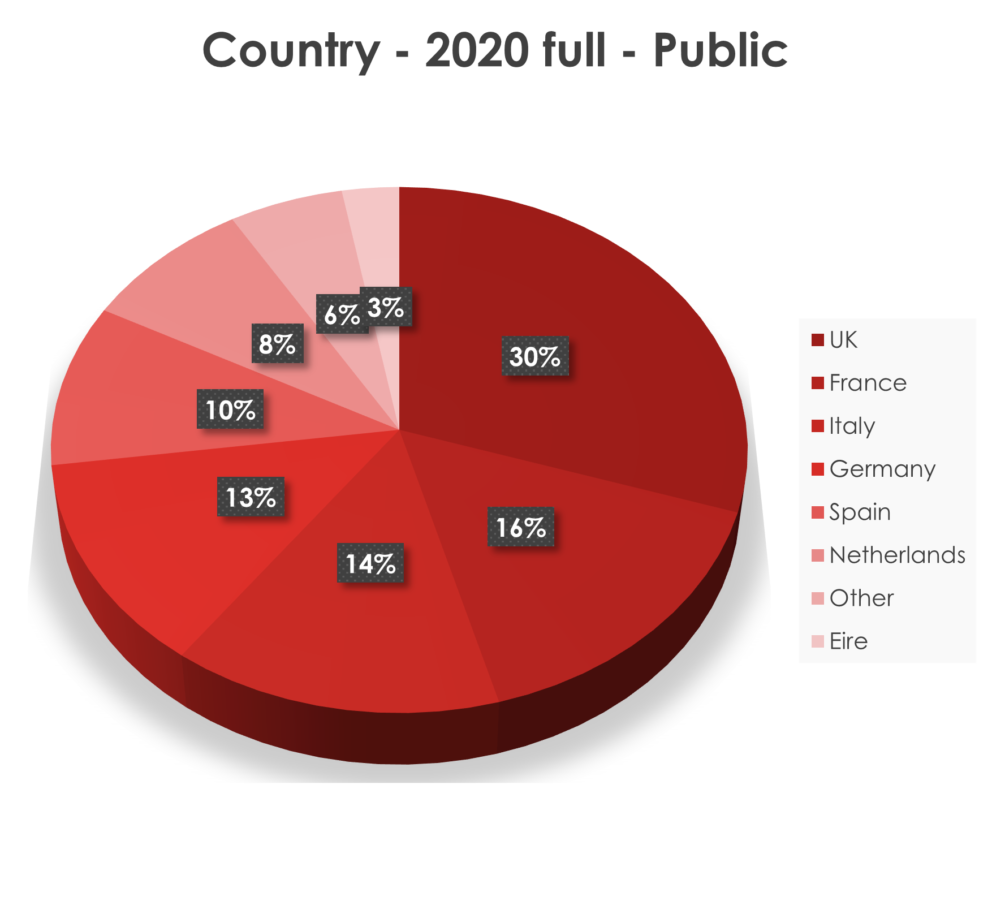

- We have not provided a pie chart for the UK STS market for the simple reason that, as of 1st June, 2021 it amounted to 9 transactions. These comprised 5 private transactions and only 4 public (2 auto deals and 2 RMBS). This dearth reflects the almost total withdrawal of the traditional bank and building society RMBS issuer (sole exception being Yorkshire Building society with their Brass deal). For comparison, 2020 full year came in at 23 public STS deals.

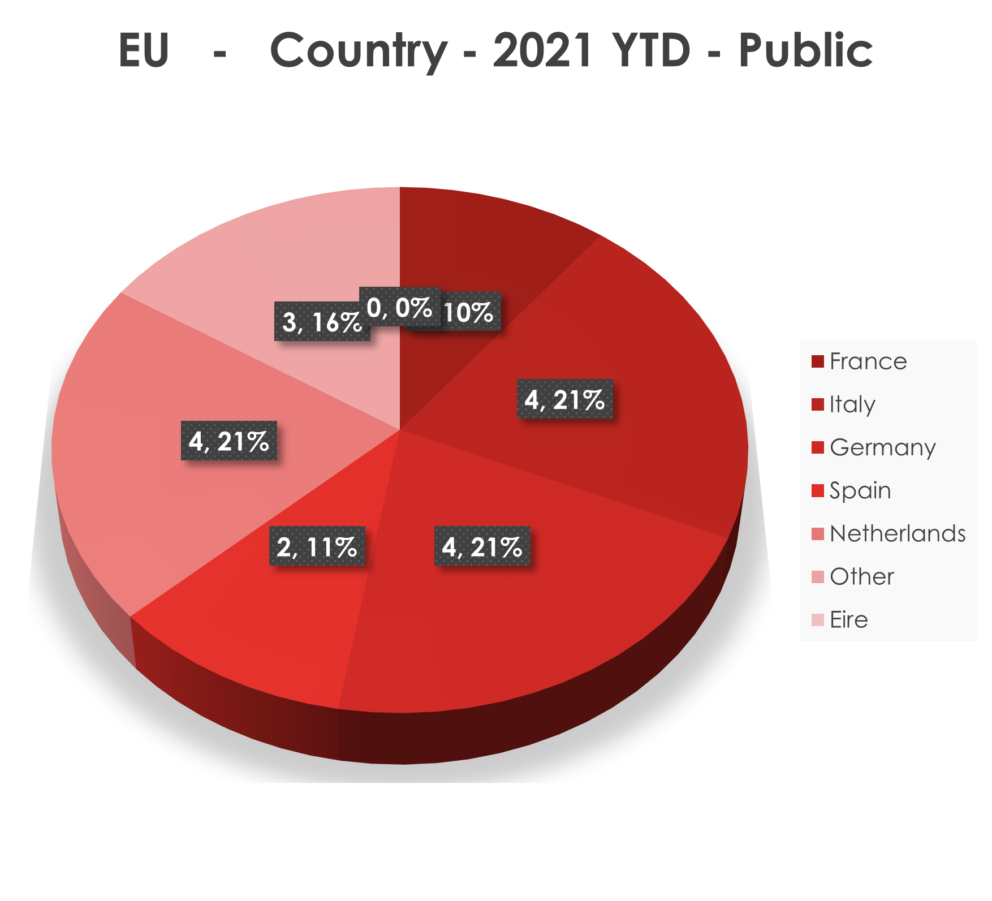

- Comparing the country pie-charts is made difficult by the removal of the UK which is, as ever, the largest issuing jurisdiction in 2020. But no dramatic shift in jurisdictional distribution so far. That said, the very small number of transactions makes statistically meaningful comments hard to come by.

Remember, as always, that PCS’ data is by deal rather than, as many research houses do, by volume. This is not that this is a better way of presenting the data but it is a different way of presenting the data which, hopefully, reveals additional information.

ESAs report on the functioning of the Securitisation Regulation

On May 17th, 2021, the Joint Committee of the European Supervisory Authorities (EBA, ESMA and EIOPA) issued its report on the regulation of European securitisation.

When we announced the publication in our News section we indicated that, subject to a more in-depth analysis, we felt the Report to be a substantial missed opportunity. This is the promised deeper analysis.

Background

The avowed purpose of the regulation was to revive the European securitisation market on a safe and sound basis. Yet, two years in, the European securitisation market continues to decline in volume.

Part of the decline of the market can be attributed to events outside the regulation, notably extremely accommodative monetary policy by the ECB and factors related to COVID-19.

But we also know from countless market participants’ interventions, but also from the work of not one but two independent experts groups set up by governments and the Commission that two key reasons for this failure to revive the European securitisation market are (a) the inadequacy of the capital calibrations for securitisation (in the CRR and Solvency II) and (b) the absence of a level playing field between the treatment of high quality securitisations and equivalent capital market instruments when it comes to regulatory benefits and burdens (including LCR treatment).

It was therefore hoped that this formal, public and very official review by the three regulatory authorities would prove to be the opportunity for them to inform the European Commission of why the regulation was failing its avowed purpose and how this could be reversed.

Executive Summary

- Although by common consensus at the heart of the regulation’s failure to revive the market, the Report merely mentions the issues of inappropriate capital treatment and uneven playing fields and studiously avoids making any comment or recommendation or even taking any position. This, the Report explains, is due to the narrow mandate provided by the article in the regulation mandating the review. PCS is not convinced that the mandate precluded a constructive commentary and maybe even the suggestion of some policy steps. If the ship’s captain sends you below deck to report of the engines, he is not likely to criticize you for exceeding your mandate if you add to your report that the keel is holed, the ship is taking water and that an immediate starting of the pumps would be a good idea.

- Even when an issue is identified, the Report often eschews putting forward a remedy. If nothing else, this shyness is likely to lead to yet more delays in implementing remedial steps.

- We consider this to be a lost opportunity for the ESAs to engage with the real issues that limit the success of an otherwise well drafted piece of legislation: the inappropriateness of the prudential benefits for such a high standard as STS and the desperately unbalanced playing field between securitisation and comparable capital market instruments.

- On the other hand, where issues are identified and proposals made, the Report is usually sensible and the suggestions constructive even if they often feel peripheral.

We now turn to the Report in more detail.

Investor due diligence

- The ESAs suggest that further guidance should be produced by the regulators themselves on what is adequate and proportionate due diligence especially around the work expected of investors on the loan level data.

- This proposal is sensible on its face but one that causes PCS deep concern in practice. First, a natural tendency of regulatory authorities that seek consensus is to gravitate toward the maximum burden. If two regulators cannot agree on how much work an investor should do, they can agree that the largest amount will satisfy both. More due diligence would not, in principle, be something PCS would be concerned about were it not for the devastating impact on the securitisation market of the unlevel playing field with other capital market instruments. When the burden on investors in securitisation is already an order of magnitude greater than investors in other types of equally risky or often riskier assets (e.g. covered bonds or corporate bonds) additional obligations can only push securitisation further underwater. Therefore, we beseech the regulatory authorities to start fixing the level playing field before adding any additional burdens on one of the players lest they find that, by the time the field is levelled, one of the players has already been permanently removed from the game.

Retention

- The Commission is invited in the Report to solve the continuing ambiguity over the applicability of the EU retention rules to non-EU or partially EU deals, using as a solution the ESAs own suggestions as set out in their earlier opinion. Although PCS is aware that the ESAs suggestion was seen as problematic by some in the market, we consider it to be in line with the spirit of the European rules.

- The Commission is also invited finally to publish the long delayed regulatory technical standard on retention to give some certainty to market participants.

Data disclosure

- Although the Report acknowledges that many participants in the market have drawn attention to the complexity and huge quantity of data that is required to be produced for securitisations, the only suggestion is that regulators should get together to coordinate better their supervision of this data.

- PCS is a strong proponent of transparency but was disappointed that, in a Report covering the securitisation regulation, the ESAs did not raise the issue of the immense imbalance in disclosure requirements between securitisations and all other secured capital market instruments (notably covered bonds). We feel that one cannot assess the impact of a piece of sectoral legislation as if it existed in a vacuum, with no reference to any other sectoral legislations covering proximate market segments. Capital markets are an ecosystem and to understand the role and impact of any of the system’s components one must look at its role in relation to other components. We do not feel that doing so goes beyond the Report’s mandate.

Private transactions

- Acknowledging that the current definition of “private securitisations” (anything that does not need a prospectus) is probably far too wide and forces a heavy burden on transactions that need not bear it, the Report invites the Commission to revisit it – but without any real guidance as to how it might want to do so, but a warning that it might be difficult.

- Extensive public disclosure for the benefit of investors in public transactions is certainly a positive aspect of the current regulation. But it is much less clear whether the extension of those disclosure requirements to certain types of private transactions really serves the overall purpose of the regulation or, on the contrary, is an unnecessary burden resulting from over inclusive drafting.

- PCS supports a reduction of the types of securitisations covered by the extensive disclosure requirements to those where such disclosure really serves the overall purposes of the regulation.

STS regime generally

- The Report provides much interesting, if dispiriting at times, data on STS securitisations.

- One of the most devastating datum is that securitisation only makes up 2.3% of insurance companies’ investments and that, of those 2.3%, only 2% are STS. So, STS makes up less than 0.05% of insurance companies’ investments. No surprise then that an improvement of the Solvency II calibration for STS was not high on the list of insurance companies’ “asks” in the recent review of Solvency II. At the same time, without such re-calibration, insurance companies will continue to shun STS securitisations – not because of risk or stigma but simply because the current calibrations are way out of line with the real risk profile. This is why PCS would strongly urge the Commission not to conclude from the fact that better calibrations of STS securitisation were not on the list of improvements of Solvency II suggested by the insurance industry that such better calibrations are not a vital part of making EU financial regulation fit for the purpose of funding European economic growth.

- Another interesting data point is that the capital treatment of STS securitisations is by far and away the benefit most valued by market participants. When one considers that the next two most valued benefits (broader investor base and better pricing) are most likely connected to the capital benefits, it is clear the central element of assessing STS and its role and future lies in capital calibration.

- The Report also mentions that comparative prudential treatments of securitisations with other capital market instruments (including disclosure burdens and costs, investor due diligence requirements and capital requirements) are essential to understand the potential of STS to revive securitisation in Europe.

- Having drawn attention to all those facts and admittedly suggesting that maybe something could be done, the Report then, unfortunately, studiously refuses to take any position on what that could be

STS criteria

- The Report notes that certain securitisations are not capable of obtaining STS: managed CLOs and CMBS but, correctly in PCS’ view, points out that this is by design – not a bug but a feature.

- The Report acknowledges that some market participants have complained of the stringency of some criteria but point out that the STS criteria are meant to define a high standard and so should not be diluted. Here PCS, although broadly in agreement, would point out that, with the benefit of having seen many criteria play out in real transactions, a few tweaks would be sensible.

- The Report spends quite some time on why there are no ABCP programs that are STS compliant, identifying the criteria that make it unreasonable for most sponsors to turn an existing conduit into an STS conduit. But having suggested that some changes could be considered, the Report muses that, since there are no practical benefits whatsoever in the existing legislation for any market participant in a conduit being STS, maybe a change in criteria would not really make any difference. We agree.

Supervision

- Carefully reading the Report, one may discern the most diplomatic of attempts tentatively to raise the issue of why the regulation of a pan-European standard was not entrusted to pan-European regulators but to national authorities with an invitation to explore some form of reflection on the possibilities of some regulatory centralisation. The ESAs are treading carefully here.

Third party verification agents

- We must thank respondents to the survey who reported that TPVs were “an additional source of guidance and control to interpret the STS requirements which is valued by investors and less experienced securitizing parties”

- The ESAs saw benefit in our work but wished that TPVs were more transparent in their interpretations of STS criteria and had more frequent interactions with national competent authorities. PCS sees no issue with both those requests and will explore how best to act upon them.

Conclusions

On a second reading of the Report, nothing has changed our initial sense that this is a lost opportunity for the ESAs to engage with the real issues that limit the success of an otherwise well drafted piece of legislation: the inappropriateness of the prudential benefits for such a high standard as STS and the desperately unbalanced playing field between securitisation and comparable capital market instruments. By not doing so, the Report did, unfortunately, not provide the rounded analysis of the functioning of the Securitisation Regulation within its ecological niche in the capital markets we think was called for.

STS criteria highlighted : Article 21(9)

Article 21(9) is one of the STS criteria that regularly has triggered debate about interpretation.

The Joint Committee of ESA’s has recently published Q&A’s that may be very useful to market participants.

One of the questions relates to Article 21(9) of the Securitisation Regulation and the answer implies that issuers may need to make adjustments to their disclosure.

The Committee answer vis-a-vis Article 21(9) indicated that “Information regarding servicing procedures should be found in a publicly available document especially where this documentation explains how the servicing of delinquent and defaulted exposures are taken care of, so as to further facilitate investors’ due diligence regarding compliance with Article 21(9) of the SECR”.

PCS views this response as clear indication that the required information referred to in 21(9) should be contained in the documents that are provided to investors. Where previously some transactions contained statements that the Article 21(9) information was contained in policies and procedures or servicing manuals to which the investors had no access, it appears clear now that the specific servicing/remediation/recovery details need to be included in the transactions documentation provided to investors. Such information could also be included in attachments to available documents (e.g., the servicing agreement) or contained in a summary within the Prospectus or other transaction documents

5. Our people

PCS is a compact organisation with a total staff of 12.

In each newsletter we will introduce one of them so that people get to know us. This time, Rob Leach, Member of the Analytical Team.

Rob Leach

I originally was trained as a credit analyst at a large commercial bank in the US and eventually became a real estate lender in the bank’s Philadelphia office. I later moved into securitization when I joined a rating agency in New York. Shortly thereafter, I moved to the London office, where I eventually came to manage the team of analysts in London responsible for CMBS ratings. In more recent years, I served in a control/risk management role responsible for quality review activities across several structured finance sectors. In 2019, I moved to PCS, coinciding with the implementation of the STS regulation and PCS’s STS activities as a Third Party Verification Agent.

When not working, I enjoy a variety of activities, since a while now including mask-wearing, social distancing and waiting for home delivery. In line with the current social trends, I’ve fully adopted the work-from-home lifestyle, enjoying the blurring of lines between work life and that other part of life formerly known as the not-at-work life. I live with two rabbits and am an adherent of “slow gardening.”