1. Welcome !

Welcome to this edition of the STS Newsletter by PCS, keeping stakeholders up to date about market and regulatory developments in the world of STS.

Read full text (reading time 1 minute).

2. A time of opportunity, a time of danger

Given the extraordinary and turbulent times and developments in the last months, in this edition of our Newsletter we diverge somewhat from the usual pattern and endeavor to make an analysis of current opportunities and threats that may affect the European securitisation market.

Read full text (reading time 8 minutes).

3. Market Data

As a regular feature of our Newsletter we will publish some statistics regarding the STS market together with a few thoughts as to what these may mean.

Read full text (reading time 2 minutes).

4. Improved format of PCS Verification Report

PCS strives to continually improve the readability and usability of its Verification Report.

As it has over the years, based on feedback and input from the investor community, PCS has introduced an improved format for the STS Verification Report.Read full text (reading time 2 minutes).

5. Our people

PCS is a compact organisation with a total staff of 14.

In each newsletter we will introduce one of them so that people get to know us. This time, Ian Bell, CEO of PCS.

Read full text (reading time 1 minute).

Welcome !

Welcome to this edition of the STS Newsletter by PCS, keeping stakeholders up to date about market and regulatory developments in the world of STS.

Given the extraordinary and turbulent times and developments in the last months, in this edition of our Newsletter we diverge somewhat from the usual pattern and endeavour to make an analysis of current opportunities and threats that may affect the European securitisation market.

In our regular features, we share updated data on the STS securitisation market. Then we briefly introduce our improved Verification Report. Finally, in the people section we present Ian Bell, CEO of PCS.

As ever, we very much welcome any feedback.

A time of opportunity, a time of danger

A war in Europe with no plausible endgame, the specter of a global food shortage or worse, the reality of inflation yet the threat of recession, a China that hangs in pandemic and economic limbo waiting to see which way the government will turn not just for the short term but also for the longer horizon and an accelerating and obvious climatic deterioration: uncertainty is not new to the world but often the range of outcomes is fairly constrained (the Dotcom crash of 2001) or the direction of change broadly understood (the oil crisis of 1973 – downward – the fall of the Berlin Wall – upward). Today, the citizens of the world seem to hold their breath as its policy makers, despite the firm speeches and confident messaging, appear tentative if not downright lost.

Before these truly global challenges, the travails of the European securitisation industry may seem below trivial. But we do not mention these challenges to generate despondency. First, we believe that the revitalisation of European securitisation could be an important component to a positive outcome for a number of these challenges. For example, even if we do not hold much hope that the success of Dutch RMBS will have an impact on the course of “Xi Jinping Thought”, it can play a key role in inflecting the course of climatic degradation. Secondly, and this is the main argument of this article, as with so much around us, European securitisation finds itself in a state of great uncertainty, with future outcomes that range from the best to the worse. And which comes to pass depends on the cumulative decisions to be made by policy makers in the coming months. The regulation of securitisation and finance generally does not operate in a self-contained technocratic bubble. Uncertainties at the macro-political level (including in central bank decision making) trickle down to what can appear to be remote reaches. In the coming months, a number of seemingly disconnected technical and oftentimes abstruse decisions (green bond definitions and capital requirements, disclosure templates and revisions to the insurance industry regulatory architecture) will play a major role in determining the fate of securitisation in Europe.

These are listed below but without going into details. The details are fairly well known and we have covered them in articles and newsletters before. The aim of going over them once more is to draw attention to their number and their interconnectivity. It is easy to see each one as a separate highly technical matter best suited to a technocratic solution. In reality, they should be approached with a full understanding of their collective capacity to shape the European securitisation market and send it towards gentle oblivion or towards playing a decisive role in funding both Europe’s growth and its transition to a sustainable economy.

With an understanding of the cumulative and inter-connected impact of these decisions we hope to encourage the securitisation community to mobilise in a coordinated way to push for the finalisation of the reforms started by the Securitisation Regulation in 2017. [mfn]See for example, “Securitisation: the Indispensable Reform” (Eurofi- page 58)[/mfn] This will require that we act together and not focus narrowly on the one or two issues that concern specifically our institutions. Even if you are not active in residential mortgage lending, the issue of green templates for RMBS should concern you. Without a viable ecological niche for securitisation in the green capital market eco-system, all securitisations will struggle. Workable templates for RMBS are part of making that niche viable.

On the policy making side, we hope to encourage concerted and centralised action at the level of the European Commission, of individual member states acting through the European Council or individually and of the European Parliament to push forward these issues as a package. We hope that these are seen as part of a global solution rather than a fragmented series of decisions to be looked at by different institutions or different departments separated by more-or-less watertight bulkheads. This is not to dismiss the institutionally necessary separate roles of the various actors. The EBA must provide the technical advice on bank capital requirements and the co-legislators must decide level 1 norms. Our plea is for this process to be integrated and coordinated across the various initiatives.

So, what are these decisions in the coming months that require a singular will and coordination?

CRR Calibration

The Commission has asked the Joint-Committee of the ESA to report back by September 2022 on a series of possible changes to the current regime. The EBA will be asked its views on the appropriateness of the calibration of the capital requirements for prudentially regulated bank holding securitisations.

PCS, together with the securitisation community, has long argued that the current calibrations simply do not reflect the data and, especially for STS securitisations, the structural qualities generated by the standard. In particular, the removal by the STS criteria of the totality or quasi-totality of the agency risks that underpin the infamous p factor should be properly reflected in the rules.

LCR eligibility

This is also part of the Commission’s request for advice. This is an issue the importance of which is often underplayed. The current rules for when a security is eligible to be included in a bank’s liquidity coverage pools do not reflect, once more, the data for their liquidity. Since this was first determined in 2014, yet more data has confirmed the original analysis. PCS has been told by a number of banks that whether a capital instrument can be included in the LCR pool (and with what haircut) is often a key determinant of the investment decision.

At a recent EBA roundtable, the banking regulators though expressed a great reluctance to engage with this particular point and the community will need to be both very focused and convincing if any progress is to be achieved.

Solvency II capital requirements

Again, this is part of the Commission’s call for advice. This time the ball is in EIOPA’s court. Currently, as with capital requirements for bank investors but even more egregiously so, the capital requirements for an insurance company holding a securitisation are often way in excess of its actual risk. The reasons for this are technical but result, by way of illustration, in the capital required by an insurance company to purchase a pool of whole loan residential mortgages with all the embedded risk being lower than the capital cost of holding the AAA tranche of the same pool in securitised format. The latter being securities that saw no loss whatsoever in Europe throughout the depth of the crisis and stresses experienced since 2008.

The reform of Solvency II is the Cinderella of this tale. Probably the most impactful change that could be made to the securitisation regime, it is the one that attracts the least interest and attention. Why? Because insurance companies no longer invest in securitisations – courtesy of the current regime. Insurance company holding in securitisations were down to 2.5% of their total book and holding of high-quality STS securitisations to a derisory 0.05% [mfn]“Joint Committee Report on the Implementation and Functioning of the Securitisation Regulation” (page 43)[/mfn]. So securitisation is not seen as “an issue” for most insurance companies preferring to expend their political capital on problems that are on their balance sheets rather than on those that could be, in a better world. This leads EIOPA to downgrade securitisation reform on its list of interest.

Yet fixing Solvency II and introducing a more rational capital requirement framework for insurance undertakings is probably the most meaningful of the calibration reforms.

Excess Spread RTS

The EBA is to publish its draft excess spread regulatory technical standard. A sensible approach to this most technical of issues is a key to allowing banks to extend the use of synthetic/on-balance-sheet securitisation for capital management.

With the finalisation of Basel 3 approaching, including some version of the output floor, the capacity of the European banking sector to finance growth in the economy and the green transition will be sorely challenged by capital requirements. Providing a safe but efficient capital management toolbox is crucial for a continent where 75 % – 80 % of all financing still comes from banks. [mfn]This is in marked contrast with the US that can take a more sanguine view of capital requirements when (a) only 25 % of finance comes from the banking sector and (b) not all that banking sector is subject to Basel 3[/mfn] The stakes are high.

Homogeneity and trigger RTS

Less crucial than the previous RTS, the EBA must also publish RTS’ on the definition of homogeneity in synthetic/on-balance-sheet STS transactions and define certain permissible triggers.

This is an opportunity, which we are confident the EBA will seize, safely to optimise the capacity of those securitisations to allow efficient capital management.

Synthetic/on-balance-sheet STS securitisation guidelines

Maybe not the most high-profile expected regulatory publication, the EBA will be drafting guidelines to interpret the STS criteria for synthetic/on-balance-sheet securitisations. Experience from the true sale guidelines, a broadly sensible and reasonable set of rules, shows that a workable approach to the detailed definition of STS should not be neglected by the securitisation community. EBA guidelines have the capacity to empower or disable whole market segments.

Green securitisation definition

We commended the recent report of the EBA[mfn]“EBA publishes an excellent report on “Green Securitisation”[/mfn] on green securitisation and especially its conclusion that securitisation did not require its own sustainability regime. Securitisations are capital market instruments and should therefore participate of the general regime for green bonds.

For securitisation, the key issue here is whether a green securitisation is a securitisation of green assets or a securitisation where the proceeds of the issuance are used to fund the transition. The EBA, the ECB, trade associations such as AFME and we at PCS are firmly of the view that securitisations should be treated as any other financing and be defined as green by the use of their proceeds. This is not just a pro-securitisation point. It is a pro-sustainability point. This approach maximises the financing of Europe’s green plan.

But technical issues in the drafting of the EU Green Bond Standard regulation have put in doubt this approach and we encourage the co-legislators to introduce the necessary amendments to remedy this problem.

General disclosure rules

In addition to the specific disclosure rules for green securitisations, as part of the review of the securitisation regime being conducted by the Commission an examination of the appropriateness of the current disclosure regime may be on the cards.

Although PCS is strongly in favour of a very robust disclosure regime, it cannot be denied that some of the current rules generate substantial amounts of data that, to all intents and purposes, are examined by absolutely no-one: not investors, not researchers and not regulators. The value of extensive disclosure in certain types of private deals that flow from traditional banking relationships is also highly questionable. Finally, the imbalance between securitisation disclosure requirements and the disclosure requirements attaching to other asset-based financings remains as egregious as it is inexplicable. Such unlevel playing fields generally bear a high risk of creating dangerous regulatory arbitrages and in the case of securitisation we believe they have indeed already done so.

A revision of the disclosure requirements would be very welcome.

The United Kingdom

All the above has focused on a constellation of decisions to be made by and within the European Union. But the UK market is bouncing along the bottom in terms of issuance.

Almost every single one of the changes described above has its UK mirror. In addition, the UK does not have a synthetic/on-balance-sheet STS regime at all which is not only unfair on UK banks but will likely constrain their capacity to fund future growth.

We therefore urge both the UK authorities and the UK securitisation community to move decisively in the direction of an improved and more rational securitisation regime along the same lines as those mentioned in the context of the European Union.

Conclusion

Through a myriad steps, Europe has the opportunity to bring about its declared aim to revitalise a safe securitisation market .… or bury it. To make it succeed, the highest policy making bodies must approach all these steps with a unity of purpose and intent. They should not see them as individual disparate steps amenable to separate technical solutions but as the components of a whole that need to work together for the common purpose.

The benefits of a strong securitisation market have been analysed at length and are pretty universally and publicly recognised. Now, once again, European securitisation stands at cross-roads. Yet, differently from 2013/2014 when all knew that the market would either survive or die through regulatory change, today, when the choice is maybe no longer survival but relevance, the importance of the moment may be less well understood.

Will securitisation dwindle into a small niche market or become the force it needs to be to fund the European economy and green transition?

That is what the decisions that will be made in the next few months will determine.

Market data

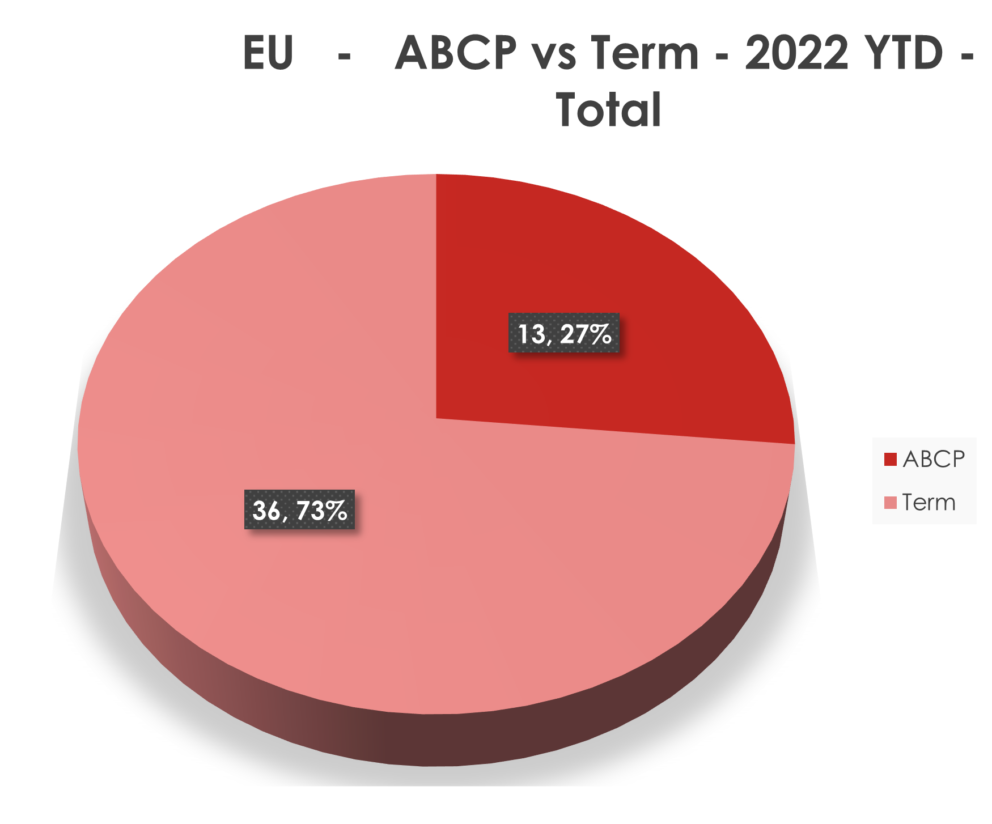

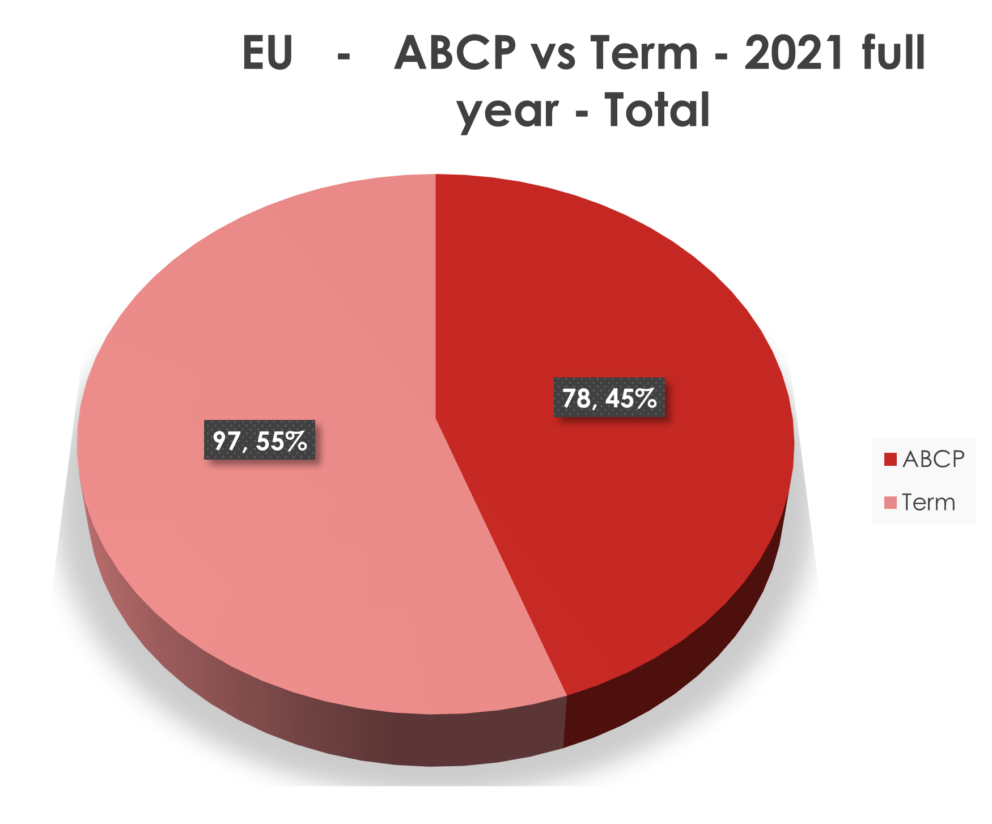

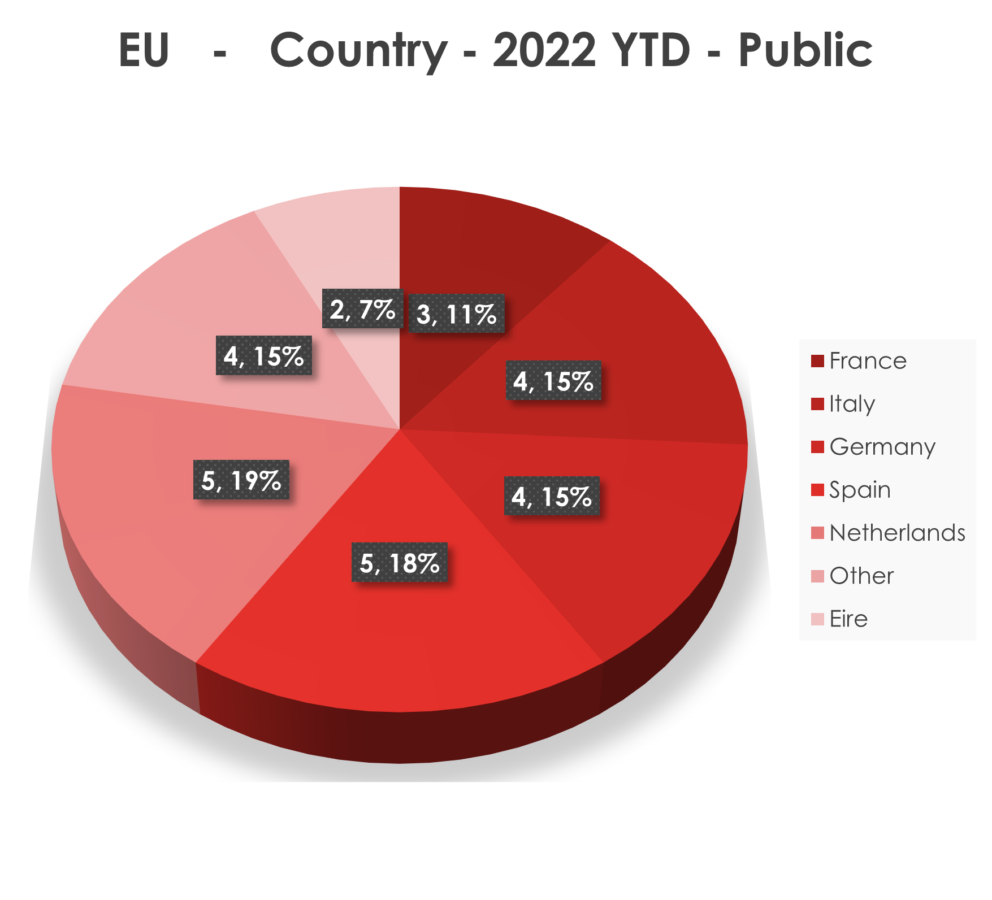

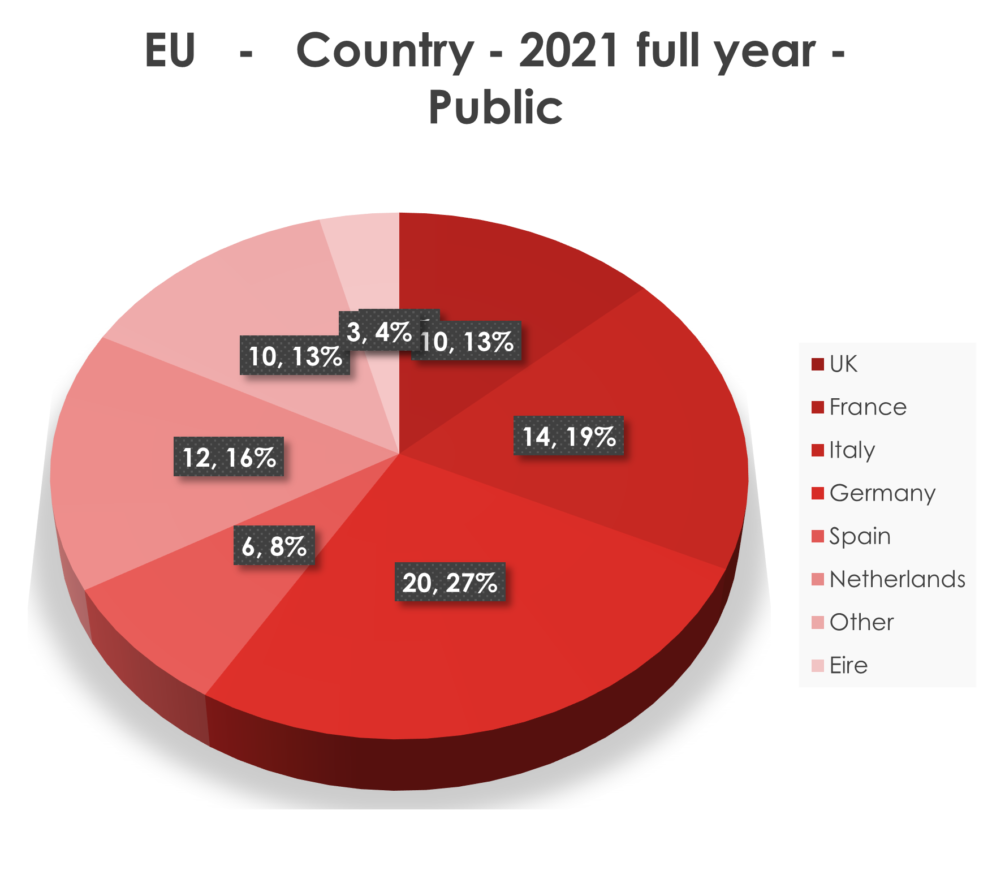

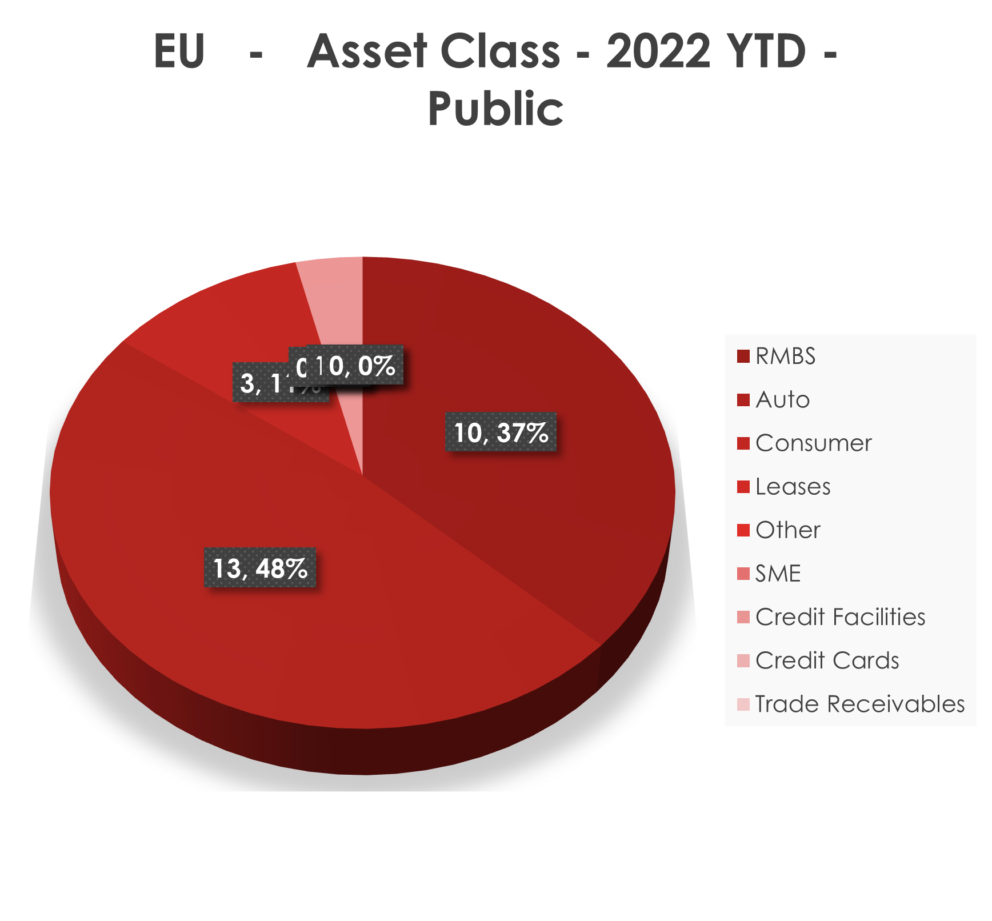

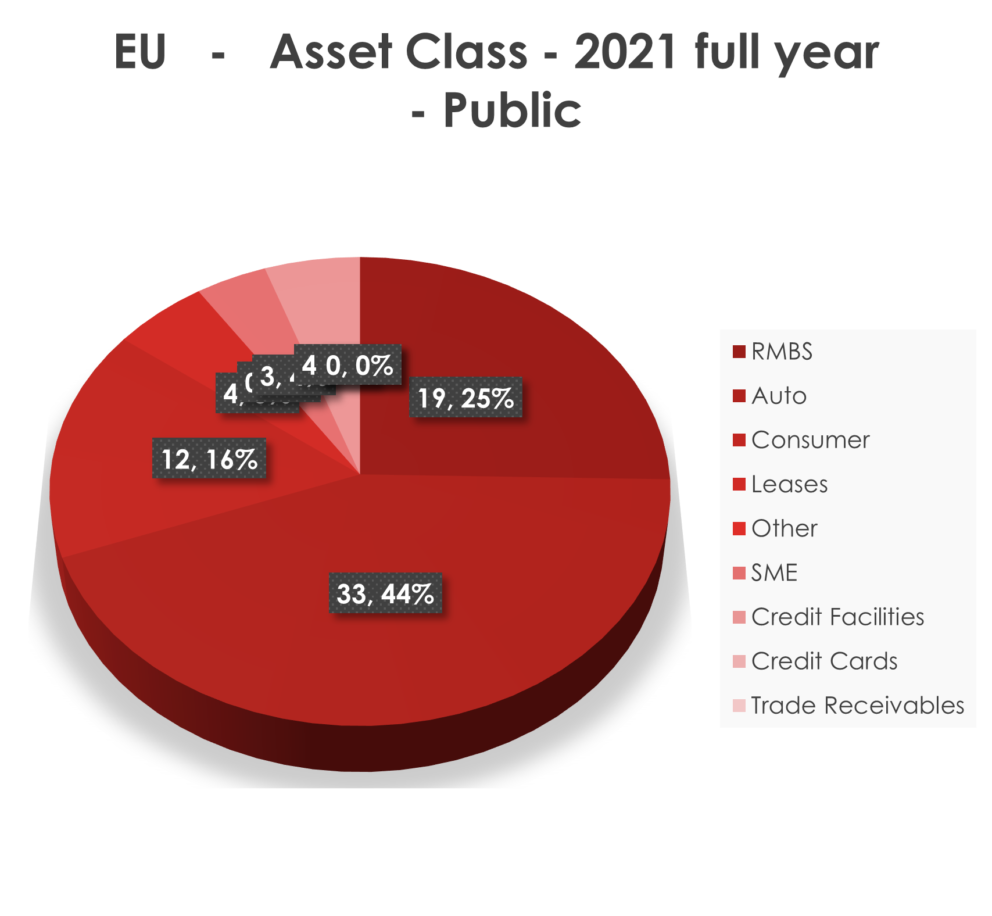

- As of June 6th, 2022, 49 transactions had been listed on ESMA’s website as STS and 8 transactions listed on the website of the FCA in the UK, for a total of 57 STS transactions year-to-date.

- Although these numbers compare badly to the 2021 full year numbers of 175 ESMA notified deals and 21 FCA notified deals, the balance of transactions does tend to fall in the second half.

- So, 2022’s 49 ESMA transactions compare to 56 on the same date in 2021. The 8 FCA transactions compare to 11 on the same date.

- Nevertheless, numbers continue to decline in what should be a worrying trend. Many, including PCS, have expressed the view that monetary tightening would lead to an increase in “plain vanilla” and hence STS issuance. The tightening is here but the issuance is not. This reinforces our argument that a flawed regulatory framework is a key brake on any revival of STS securitisations.

- With 17 auto STS deals so far this year in the EU versus 12 RMBS deals, the relative decline of mortgage backed securities as the backbone of the STS market shows no sign of reversing itself.

- So far in 2022, 8 synthetic transactions have been notified STS to ESMA, versus a full year total of 15 in 2021. We are not sure how much should be read into this as STS only became available half way through 2021 but many synthetic transactions tend to take place towards the end of the year.

Remember, as always, that PCS’ data is by deal rather than, as many research houses do, by volume. This is not that this is a better way of presenting the data but it is a different way of presenting the data which, hopefully, reveals additional information.

Improved format of PCS Verification Report

PCS strives to continually improve the readability and usability of its Verification Report.

As it has over the years, based on feedback and input from the investor community, PCS has introduced an improved format for the STS Verification Report.

The most important changes to the report are the merging of certain criteria points, to create a shorter and more streamlined checklist, improved visuals and the addition of some navigation buttons.

The number of criteria points has been reduced from 103 to 85, significantly shortening the checklist. While the number of individual points in the checklist has been reduced, there has been no change in PCS’s methodology or criteria in verifying STS compliance. The shortening of the checklist results instead from merging several of the previously separate but closely-related criteria points.

The checklist has also been updated with a cleaner visual format and colour template, designed to enhance its readability. Additionally, navigation buttons have been added to aid in moving between various sections of the checklist.

We have also updated the checklists for our CRR and LCR Assessments with a cleaner visual format and colour template, to enhance readability and to align the visual format and colour template between the various PCS checklists.

See here for an example of the new format of the PCS Verification Report.

Our people

PCS is a compact organisation with a total staff of 14.

In each newsletter we will introduce one of them so that people get to know us. This time, Ian Bell, CEO of PCS.

Ian Bell

I was trained as a lawyer and joined Clifford Chance as a trainee in 1987 where, in April 1988, my life collided with the nascent European securitisation market in the form of TMC 4, the fourth UK mortgage backed transaction. Foolishly, rather than run away, I embraced the madness and worked pretty much exclusively in the field of securitisation, first as an associate, then from 1996 as a partner. I left in 1999 to become European General Counsel at Standard & Poor’s before being asked to move to the “business side” and run the structured finance group in Europe, Africa and Middle East, spanning the GFC. I was then asked in 2012 to helm PCS.

My personal tastes run to good food and wine, both in the cooking and eating, and then cycling and triathlons to get rid of inevitable consequences. I read mainly history, science fiction and some physics.