Welcome…

..to this first look at the European Commission’s proposals published this week to reform the regulations governing securitisations – the “Proposals”.

(If you wish to read the full set of official documents, you can find them here.)

To be clear and based on a fairly subjective back of an envelope count, the Proposals include over 40 meaningful measures, a entire new category of securitisations, a sevenfold division of transactions where there used to be two and a whole bunch of new formulae. In other words, what we are proposing to do in this paper is not a deep-dive or a detailed analysis but a first skim over the Proposals, giving the highlights and a general sense of things as we see them.

Warnings:

Because of the complexity of the published package , the lawyers and the numbers people are still looking at the details. While the numbers are being crunched and lawyers pour over the texts, the impact of some of the proposals remain uncertain. So, on some of the measures, the jury is still out on whether the market should punch the air in elation or hang its head in despondency . Therefore, we reserve the right to recalibrate our comments if it turns out that our original gut-sense is not backed up by legal or mathematical analysis. (Short form: we could be way wrong).

But also remember, these are proposals. There will be many opportunities to correct any obvious mistakes or fine-tune any facet of the proposals. (See “Process” below)

The “Big Picture”

If you are not interested in the details of the Proposals, here is a summary of the big picture.

- This is a very positive set of Proposals for the market. It seeks and broadly succeeds in balancing prudential conservatism with laying down the basis for growth of the European securitisation market. Taking into account its breadth, it is, of course, not perfect. A number of aspects will need to be reconsidered. But the details that will need modification should not detract from the overall positive reception the Commission’s work deserves.

- When explaining the rationale for the Proposals, the Commission rightly focuses not only on the benefits securitisation can bring to banks but also to its capacity for generating high quality investments for European savers. This is worth remembering: the growth of the securitisation market is an SIU project, not a banking one.

- The Commission makes it explicit that the Proposals are a “package”. This reflects its understanding that a market is an ecosystem. An ecosystem functions properly when all its components mesh. Take out or weaken any component and the whole system can fall apart.

- Reflecting on this ecosystem approach, the Commission must be commended for resisting the temptation to limit its proposals to what could be perceived as politically “low-hanging fruit”. The Proposals pretty much cover every aspect that stakeholders indicated needed attention. Whether one agrees with the Commission’s proposals in every case, one cannot criticize the ambition of the project.

- The Proposals acknowledge the creation of multiple safeguards in 2017 as well as the creation of the STS category. Those safeguards mean that European securitisation should not be considered as a singularly, if not even uniquely, risky asset. It deserves, in its current form, to be regulated as just another capital market instrument on a level playing field with others. Admittedly, this is not always followed through in the Proposals but the principle (especially for STS) is recognised.

- The recognition of the value of the 2017 reforms means that the Proposals very much build on those reforms. They correspond to a modification of some aspects of the current architecture and not a rebuild. This also means that the Proposals are not an attempt at deregulation but rather a consolidation and recalibration of the existing framework.

- What is clear from the above is that the Commission is also not proposing to trade prudential safety for politico-economic benefits but to introduce changes that maintain prudential conservatism but strip out useless onerous aspects. Two expressions used extensively in the Proposals are “undue” and “unjustified”.

- Broadly, the two categories of securitisation that benefit most from the Proposals are STS (especially senior tranches) and synthetic SRT transactions.

- Reading between the lines, the Proposals appear to place great reliance of an upgraded supervisory oversight. For a number of reasons we think this may be optimistic especially in its expectations of granular oversight of transactions.

Process and timing

Process

From a legislative point of view, the Proposals contain six separate strands:

- Changes to the Securitisation Regulation (the “SecReg”)

- Changes to the Capital Requirements Regulation (the “CRR”)

- Changes to the Solvency II Delegated Act (capital requirements for insurance investors)

- Changes to the Disclosure Delegated Act (the disclosure templates)

- Changes to the Liquidity Coverage Ration Delegated Act (rules for HQLA eligibility)

- Changes to the UCITS Delegated Act (lifting the 10% of issuance limit for UCITS – being considered but not promised)

The first two (SecReg and CRR) are level 1 texts. This means that they are primary legislation that can only be amended by the co-legislators, namely the European Council and the European Parliament, voting the same text.

The others are level 2 texts. This means that they are secondary legislation that can be passed by the European Commission with the co-legislators only having a veto right. Neither Council nor Parliament can amend the Commission’s proposals: they must vote them down. If they do nothing, the text becomes law.

(Note that level 2 legislation is passed by the Commission. This is important as it means that when we speak of “the ESMA templates”, these may be drafted by ESMA but they are passed by the Commission and the Commission not the regulators have the last word on what is tabled).

The published Proposals contain the draft legislation amending the SecReg and the CRR. This will now go to the Parliament and the Council. The Economic and Monetary Affairs Committee of Parliament (ECON) will discuss the Commission texts and propose amendments. After discussions and political bun-fights within ECON, a text will be agreed. This will be the Parliamentary text. The same happens in the Council. This will result in a Council text. Unless a miracle occurs, both texts will not be identical and neither will be the same as the original Commission proposal.

When you have both texts agreed, the Commission convenes the infamous trilogues. This is a series of meetings where Commission, Parliament and Council argue, horse-trade and politic until they agree a single consolidated text.

Once a single text is agreed, it is put to the vote of the full Parliament and the full Council and becomes law.

The level 2 texts are drafted by the Commission based, usually, on proposals from regulators. They are tabled and if no objection is made by Parliament or Council, become law after one or three months (don’t ask).

Currently, only the proposed level 2 text amending the LCR rules has been published by the Commission.

Timing

For market participants eager to trade based on the Proposals, I have bad news. As in Einsteinian relativity, time in legislative land does not pass at the same speed as in the land of markets.

Big picture: it is extremely unlikely that the Proposals, assuming they are passed in broadly the same shape as they currently appear in the Commission text, become law before mid-2027. Yes, that’s 2027.

First, Parliament and Council are not bound to any timeframe. They can discuss the texts for one month, one year or one decade. (Actually, not one decade since the end of a Parliament brings to an end any legislative project. So they have till 2029.) Based on experience leavened by a dose of optimism, we would expect that a (very) speedy resolution would see the texts come out of Parliament and Council by mid-2026.

Trilogue too has no fixed time. Some text have never emerged from trilogue. But again, a speedy process would see trilogue wrapped up in a couple of months. Since August does not exist in Brussels, we are now in September 2026. Translation, voting in plenary and publication add a couple of months. So for the texts to become law wait till Nov/Dec 2026. A speedy coming into force would be either 3 or 6 months later. And here we are in mid-2027.

And that is the optimistic scenario.

We have often been wrong, of course, and miracles have been known to happen. So feel free to pray to your chosen deity or deities. But this is the timeframe insiders will give you.

SecReg – Mostly good news, some good surprises and a couple of potential depth-charges

Let us now do a shallow dive into the actual content of the Proposals. As we said at the outset, this is merely a selection of the extensive proposals being made. We picked those we thought most relevant. But relevance being in the eye of the beholder, if you do not see your favourite proposal here, that’s life.

Private vs Public

- The definition of public transaction is extended to anything listed and any transaction where the terms are presented to investors on a take-it-or-leave-it basis.

- Private transactions will need to provide data via Securitisation Repositories.

- But the data to be provided in private deals will be based on a new yet to be designed template, reflecting only what regulators (rather than investors) need. The Commission is explicitly referencing the ECB templates. Only regulators will see this data.

- This does not sound unreasonable since macro-prudential regulators do have a legitimate interest in being able to discern whether systemic risks are building up in the system.

- What about non-EU issuers? Based on our reading, their obligations will, like those of EU issuers, depend on whether their transaction meets the private or public definition.

Due Diligence

- Mandatory due diligence is drastically reduced with the disappearance of most of the prescriptive lists of items to look at and their replacement with a principled based approach that explicitly mentions lower standards for senior tranches and repeat transactions.

- Also eliminated altogether are most specific due diligence obligations when the issuer is an EU supervised institution.

- This includes the obligation to due diligence STS.

- To the extent this explicitly is based on the notion that regulators will be doing granular supervision of transactions, we feel this is optimistic and possibly a tad unrealistic in many jurisdictions.

- Two specific proposals undermine in our view the aims of this part of the project and are probably two of the most problematic aspects of the entire Proposals:

- Investors are added to the list of entities that can be fined 10% of worldwide turnover. A principled based approach is good but requires the making of judgement calls. When the wrong call can, in theory, cost you hundreds of millions, your compliance department is likely to ask you to do everything.

- Investors who invest through asset managers are explicitly on the hook for any due diligence failure of their delegatee. If you can be on the hook for hundreds of millions because of a bad judgement call and it is not even your judgement call then…

Disclosure

- These will have to be redrafted by the Joint-Committee of the ESAs (and not simply by ESMA).

- The Commission has made it clear that they expect the templates to be at least 35% smaller than currently.

- But the very good news is that the Commission has also proposed the creation of “voluntary fields” with the 35%+ reduction being in “mandatory fields”.

- In other words, the process will NOT be via new templates (and new IT spend for originators) but via declaring at least 35% of the existing templates voluntary.

- No loan-by-loan disclosure for granular pools at last.

STS rules

- These remain broadly the same so no new inclusions such as managed CLOs.

- Some small technical and sensible amendment to a few specific criteria.

- A favour for that perennial favourite child of European policy makers – the SME. Pools with 70% of SME loans can be treated as homogeneous irrespective of what is put in the other 30%. This may need a little rethinking since, as drafted, this exception may allow quite a bit more than the Commission envisaged.

- In a welcome surprise, the Proposals also allow unfunded synthetic SRT transactions to be STS provided the protection seller is an insurance company meeting certain criteria – namely being a multiline rated at least CQS3 with Euro 20 billion in assets and using an internal ratings model to assess risk.

- We are not entirely sure why having an internal model is relevant to the likelihood of the protection seller meeting its obligations. It feels like something EIOPA asked to be added but we are not sure it has its place in a securitisation rule. Also, we do not know at this stage how constraining it might be so we reserve judgement.

Regulatory Oversight

- There are a lot of provisions about the way in which regulators will have to conduct oversight of the European securitisation market.

- Most market participants’ eyes tend to glaze over when the minutiae of regulators’ internal arrangements are discussed, but we would advise close attention be paid as the Commission clearly has a vision of a more inclusive and encompassing role for regulatory authorities. This could have either a very positive or very negative impact on the market’s growth potential depending on the final landing spot.

CRR – “Why do simple, when you can do complicated and it works as well?”

This is the part which has the mathematically inclined rubbing their hands and everyone else wondering if the acquired knowledge is worth the potential brain damage.

The Proposal covers three areas of the CRR.

- Modifying the floors by introducing “risk sensitive floors”

- Reducing the p-factor

- Simplifying the SRT tests and the process for obtaining SRT confirmation

If these three bullet points mean absolutely nothing to you or are already inducing nausea, we suggest you stop reading here.

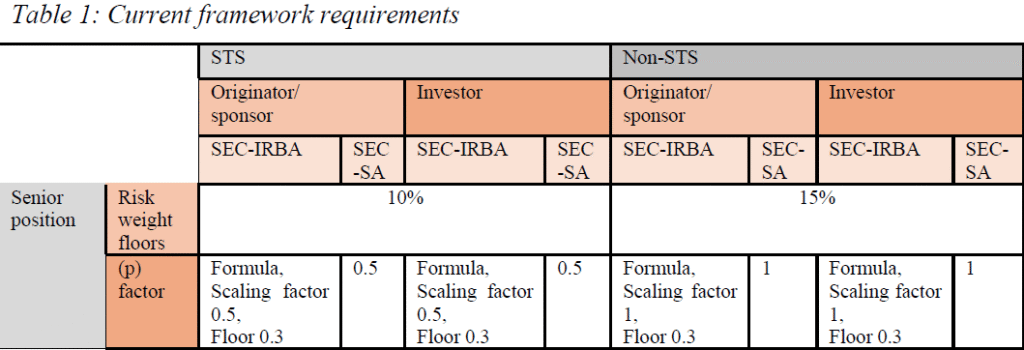

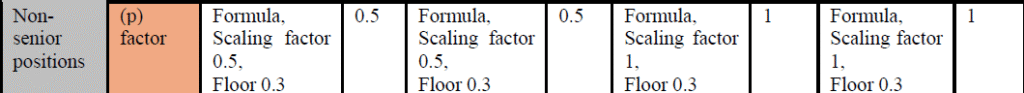

The way the Commission is proposing to implement the first two bullet points is by:

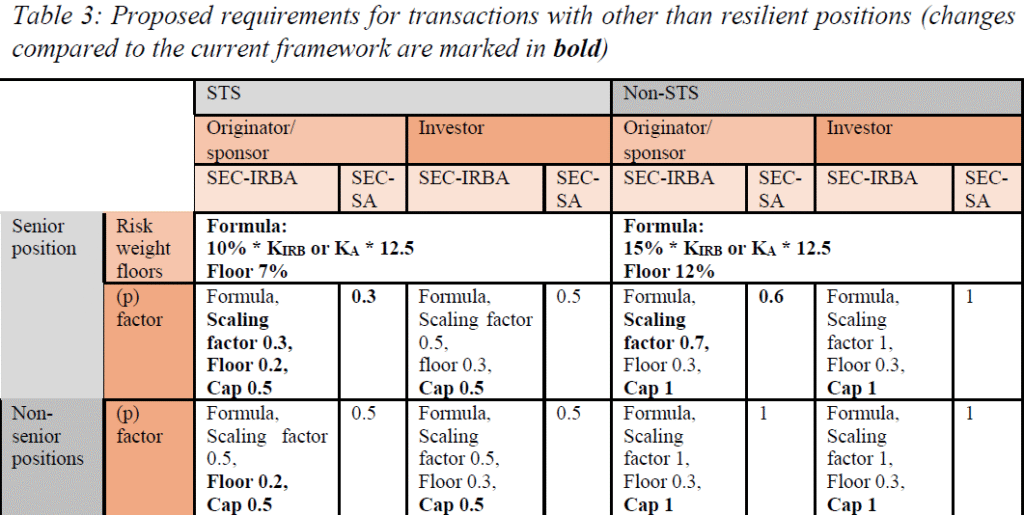

- Introducing a new category of securitisation: the “resilient” securitisation. This category is not alongside the existing STS category but as an overlay. So whereas we used to have STS and non-STS, we now have STS-resilient/STS-non-resilient/non-STS- resilient and non-STS-non-resilient.

- Differentiating between securitisations held by originators or sponsors and securitisations held by third party investors. This is not illogical since the p factor is supposed to account for model and agency risk. These are clearly much lower when the securitised assets are the investor’s own assets.

- But this scheme now leaves us with seven types of securisations with seven different treatments to replace the old two (STS/non-STS) since the previous four types now come in two flavours each: originator/sponsor held or investor held.

- Errrr…. two times four is eight, not seven. Oh innocent child, that is because one of the types (investor held non-STS resilient) is simply not allowed. So seven.

Resilient securitisations

- To be a “resilient securitisation” a securitisation must (to summarise):

- have sequential amortisation or pro-rata to sequential triggers

- 2% granularity

- if synthetic, be funded (so bad luck for insurers just allowed to write unfunded policies)

- have a minimum tranche thickness

- In addition, as mentioned, even when meeting these criteria, a non-STS securitisation held by a third party investor can never be “resilient”

- Since the first three are already STS criteria (save for the new unfunded insurance synthetics) an STS transaction only needs the requisite tranche thickness to be “resilient”

- We are aware that a number of houses are crunching numbers as we write and you read to determine how problematic achieving the appropriate tranche thickness would be for different securitisations (ie what is the correlation between the CRR required attachment point and the AAA/AA attachment point). The jury is still out and our view on the necessity of the whole resilient category will be coloured by the answers.

Floors and p’s

- The floors will become “risk-sensitive”. That means dependent on the RWAs of the underlying assets rather than being the same for all asset classes (ie 10% for STS and 15% for non-STS)

- This makes sense but note that for certain asset classes with very high RWAs (eg 150%) the new risk sensitive floors will increase the capital requirements from where they are now.

- But to avoid the capital dropping too far down, even the floors have floors in the new dispensation.

- There is still only one p-factor instead of the proposals for two p’s proposed by PCS or the scaling factor proposed by other market participants.

- The p now depends on which of the new categories you belong to.

- There are still many highly technical discussions to be had. For example is KSA a better term than Kirb or KA in the floor equation based on the impact of losses?

- Subject to those technical debates, though and broadly speaking the proposals feel right.

No point in wordsmithing this Rubik’s Cube. Here are the Commission’s handy tables.

Significant Risk Transfer

- The main change is the much heralded death of the mechanical tests for SRT and their replacement with a “principle based approach” giving us a new acronym: “PBA”. This is a welcome development although much will turn on its technical deployment.

- The Proposals also contain a slew of technical changes. The lawyers and quants though are pouring over them to gauge their likely impact. That said, they appear to have been broadly well received by market participants.

- Finally, there are specific proposals to both speed up SRT confirmation from regulators and attempt to ensure that the rules are applied similarly across the EU. This can only be good.

Conclusions

- To be fair to the Commission, the extra complexity created by splitting transactions between originator/sponsor held and investor held is logical.

- Whether we really needed a new “resilient” category depends in some way on whether the definition of tranche thickness would encompass all or nearly all existing STS trades. If it does, then it is hard to see why tranche thickness could not have been added to the current definition of STS. This would be much simpler.

- Even if the tranche thickness definition would be difficult for a number of STS transactions, the very small difference between the treatment of STS resilient and STS non-resilient begs the question of whether it is really visible in the data and/or is worthwhile

- The good news is that the added complexity is “formulaic”. By that we mean that the categories are clear and so the various components of the new rules can fairly easily be included in the formula used by differing investors. The complexity, in other words, does not require many additional steps or produce different outcomes transaction by transaction.

- On the other hand, one aim of the Commission is to remove any lingering stigma attaching to securitisation as a complex and opaque product. A seven category, floors with floor scheme does not really scream “simple and transparent”.

LCR – “Almost there”

Published also this week, the proposed changes to the eligibility criteria of securitisations for inclusion in the liquidity coverage ratio pools of banks is a very positive development. We have often described the LCR rules as the Cinderella of securitisation reform. Often forgotten but whose impact on the market’s growth potential, if correctly recalibrated, is considerable.

The Proposals do not include moving securitisations from category 2B to category 2A and even less category 1. But we have argued for a considerable time that the importance of this category issue was overstated.

The main reasons, in our opinion, for the homeopathic quantities of securitisations in bank LCR pools are disproportionate haircuts and a ratings’ cliff. The ratings’ cliff is caused by the fact that only AAAs are allowed. This means that any treasurer putting securitisations in his or her LCR pools has to be prepared to sell them all if a one notch downgrade occurs – for example as a result of a change in rating agency methodology in its sovereign ratings.

Eligibility

- Currently, only senior tranches of STS securitisations meeting some additional criteria are eligible for inclusion in the LCR

- This remains the same as far as only senior STS tranches can be eligible

- But the asset class restrictions are removed, so an STS securitisation of any type of asset can now enter the LCR pools

Ratings

- The allowable ratings are extended from AAA only to a range going from AAA to A-.

- This is fine but a range extending over the whole investment grade universe seems more intuitive.

Haircuts

- The current haircuts are 25% for securitisations of mortgages and auto-loan and 35% for everything else

- The new proposed haircuts are:

- 15% for senior tranches of resilient STS (if the deal is at least Euro250m in size) when rated AAA to AA-

- 25% for senior tranches of non-resilient STS irrespective of asset class but rated AAA to AA-

- 50% for senior tranches (resilient or not) when the rated A+ to A-

- No more 35% based on asset class

- At 15%, the haircut is similar to the least strong covered bonds. Data on the relative liquidity of covered bonds and the best AAA STS securitisations call into doubt this differential. A data based calibration of 10% seems more grounded.

- The value of this 15% haircut will also depend on how realistic is the definition of the necessary tranche thickness. If it is commercially unachievable for many transactions then this will not move the needle much. We await the number crunchers.

- Also, the increase in the haircut from 15% to 50% at A+ seems unrealistic. We think a better approach would be to have an intermediate haircut of 35% at A+ to A- rising to 50% below A- (assuming our recommendation to allow the whole investment grade universe is implemented)

WAL limits

- Another welcome proposal is the removal of the limit on maturities that allowed only short dated securitisations to be included in the LCR pools.

Conclusions

- Despite a few gripes, we should not lose sight of the fact that this LCR proposal is a major step forward in correcting the miscalibrations of the current framework. This does depend though on the tranche thickness point required by the resilience definition not excluding a wide universe of otherwise solid securitisations.

- These LCR proposals are out for consultation if you are quick – deadline is four weeks from now on July 15

Conclusions

This is a shallow dive missing many additional technical proposals. Also, on a number of issues we await the results of the work of lawyers and quants to reach a final conclusion.

Also, as mentioned before, this is a proposal. So obvious errors or technical problems can (and probably will) be sorted out during the Parliamentary and Council amendment phases. So no need to panic if you have spotted something that you feel unfairly destroys your business model.

However, the Commission should be commended for an extremely comprehensive and ambitious project and for taking technically reasonable but politically bold positions.

This is the start of a long process that will require all stakeholder to pay attention and be prepared to argue their case before the policy makers in a cogent and convincing way. The road remains long but it is finally going in the right direction.