Process & Key Steps

This section sets out the key elements for the completion of an ABCP transaction verification.

We strongly advise all visitors to this site to read our “Disclaimer” below for a better understanding of the nature of a PCS verification.

At the heart of a PCS verification lies the checking of all STS criteria off our Master Checklist.

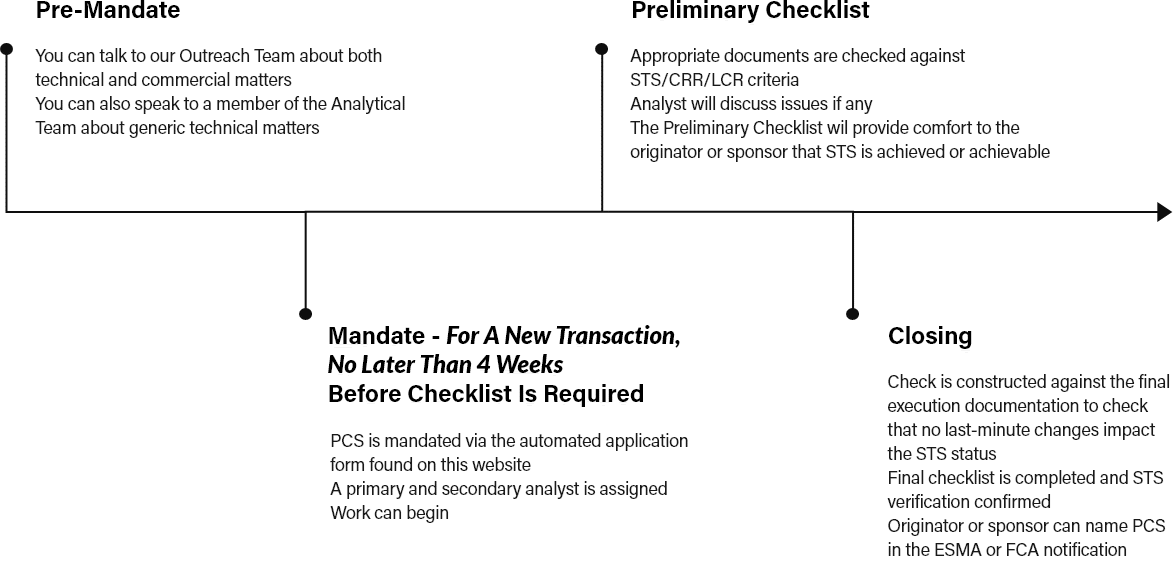

The originator should then fill the online application form and submit it well before the expected date of notification to ESMA. As the time that will be required to perform any STS verification may vary considerably depending on a constellation of factors, the applicant should hold discussions with PCS as early as possible to estimate the necessary timeframe.

To comply with the STS Regulation, PCS will not be able to start work on any transaction without an application form signed by the originator.

To fill in the application form, you can access our online application function directly from the button on the top of this page.

As the United Kingdom legislation does not allow synthetic securitisations to benefit from STS status, only PCS EU is able to verify transactions and only EU transactions may qualify for verification.

Fee Amount

Fee Amount

Fee Amount

Fee Amount

*These fees are the base fees for an ABCP verification. PCS' ABCP fees are subject to caps and rules for multiple conduits. For a full understanding of our ABCP fees, please consult our Fees Schedule. Where applicable VAT will be added to these fees.

A PCS ABCP Verification consists of the verification of each STS criterion using as guide and template the PCS Master Checklist. The ABCP Master Checklist can be downloaded at the bottom of this page.

If required, PCS will provide the originator or sponsor with a preliminary checklist prior to the close of the transaction. The final checklist may only be provided once the documentation has been finalised.

If an issue arises, PCS will seek to resolve it with the originator or sponsor and their legal advisers but always bearing in mind that, in line with its regulatory obligations and its Code of Conduct, no interaction with an originator, sponsor or its agents can be such as to amount to any form of advice or recommendations.

Once PCS is satisfied that appropriate evidence of compliance with the STS criteria can be found in the relevant documents, it will confirm to the originator or sponsor that, in PCS’ opinion, the transaction meets the STS requirements.

PCS has been authorised to perform STS verifications both throughout the European Union by the French Autorité des Marchés Financiers and in the United Kingdom by the Financial Conduct Authority.

Please note that, to comply with our regulatory obligations and to avoid any suggestion of a conflict of interest, the fee is payable by the originator from the moment an application is received by PCS and is not dependant (save is some exceptional cases set out in our terms and conditions) upon the completion of an STS Verification or the outcome of any verification procedure.