EBA publishes the RTS on “synthetic excess spread” achieving a sensible and balanced approach

Following their consultation last August the EBA has just published the final draft regulatory technical standard (“RTS”) on the capital treatment of synthetic excess spread.

Although a seemingly exceedingly dry and technical subject, the impact of this paper on the European banking industry should not be underestimated. In the last few years, synthetic securitisations have become a key capital management tool for an increasing number of European banks. Without such a tool, the risk of the exiguity of bank capital, in the near future, constraining the credit available to European borrowers was substantial. The regulatory treatment of synthetic excess spread was likely to play a key part in the availability of this tool, especially for asset classes with higher default rates but higher yields.

PCS has yet to read with care the entire RTS, but our preliminary take is that the EBA has allowed a derogation from capitalisation for synthetic excess spread that is the lesser of the actual cash excess spread generated from the securitised assets and one-year expected loss.

This is a sensible result for which the EBA should be commended. First, PCS has always accepted that synthetic excess spread can be abused to provide disguised credit support. Therefore, capitalisation of excess spread at some level has always been a legitimate prudential requirement. But if the excess spread contracted in the synthetic securitisation is less than or equal to the excess cash generated by the assets, there can be no disguised credit support since the issuer is only providing the investor with the benefit of cash it actually receives. It is an uncontroversial fact that banks need not allocate capital against revenue.

The RTS also provides for a cap on the amount of synthetic excess spread that can benefit from the derogation equal to one-year's expected loss. This reflects the STS criterion and thus avoids what could otherwise have been a perverse result of tilting the field in favour of non-STS securitisations.

Finally, the RTS allows grandfathering of existing trades, avoiding an unnecessary dislocation in the banking sector's capital management.

So, by exempting synthetic excess spread below actual cash received from capitalisation (up to one year expected loss) but capitalising anything above, the EBA has provided, in our opinion, the right balance between meeting legitimate prudential principles and not unduly punishing equally legitimate uses of actual excess spread. In our estimation this sophisticated and grounded approach should allow synthetic issuance to grow whilst avoiding the possibility of abuse.

EBA publishes consultation paper on Guidelines on the STS criteria for on-balance-sheet (synthetic) securitisation

The European Banking Authority has just launched a consultation on the guidelines for the STS criteria for on-balance-sheet securitisation.

Given the growth of on-balance-sheet (synthetic) securitisations since the inclusion in Q2 2021 of synthetic securitisations to the STS framework this is quite important.

We will, in due course, review the paper and publish our views.

A public hearing will take place via conference call on 30 May 2023 from 14:30 to 15:30 (CEST).

The deadline for this consultation is the 7 July, PCS will, of course, be responding.

The AMF publishes its investigation of STS practices by French banks – it was not impressed

The French AMF, in its capacity as national competent authority under the Securitisation Regulation, did a spot check of five unnamed financial institutions issuing STS securitisations. The regulator looked at the institutions’ procedures around the issuance of STS securitisations generally, then examined in detail a number of transactions. Their conclusions are now published in the form of a report (in English)

It would be fair to say that the regulator was deeply unimpressed by what it found in a number of cases. They expressed the view that, for several institutions (unnamed to spare blushes), the processes around the due diligences of the STS nature of a transaction were weak to barely existent. They also concluded that some transactions failed to meet one of the criteria regarding SPVs.

We would be superhumanly modest if we did not draw attention to a strong recommendation made by the AMF to French originators to mandate a third party verification agent. Something they describe as a “good practice”. We are grateful to the AMF, as an impartial and knowledgeable actor, for their recognition of the added value that we bring to the STS process.

PCS welcomes both the spot checking and the report as visible evidence of a phenomenon that we are witnessing across many European jurisdictions: national competent authorities have begun to examine with care the practices and criteria around STS issuance. When we see the complexities and subtleties our analysts wrestle with each day, we can but conclude the risk of an originator without a thorough understanding of the rules being caught on the wrong side of the STS line have considerably increased.

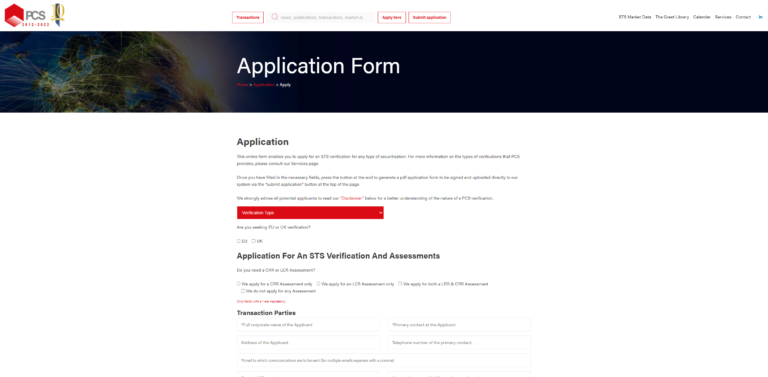

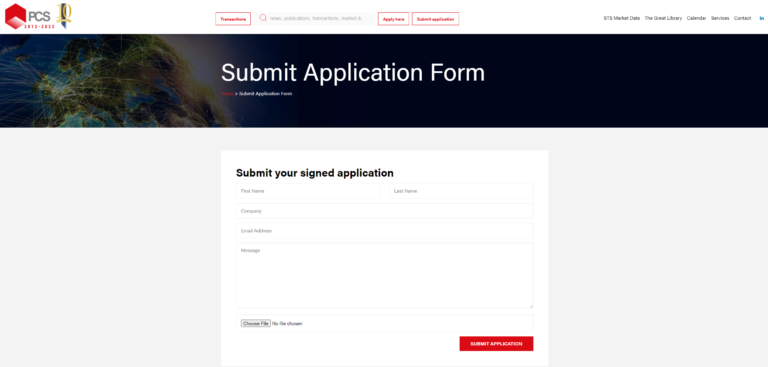

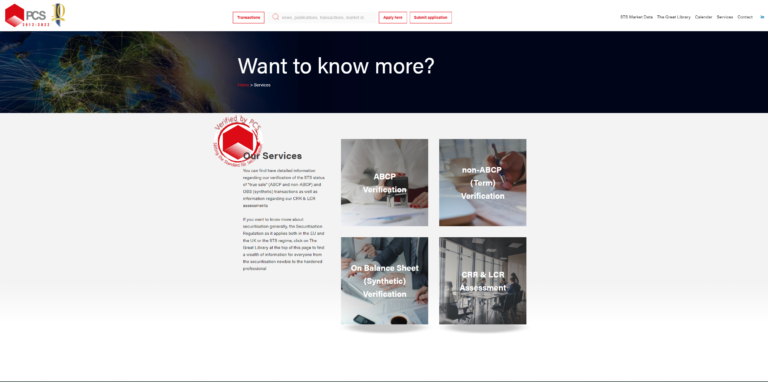

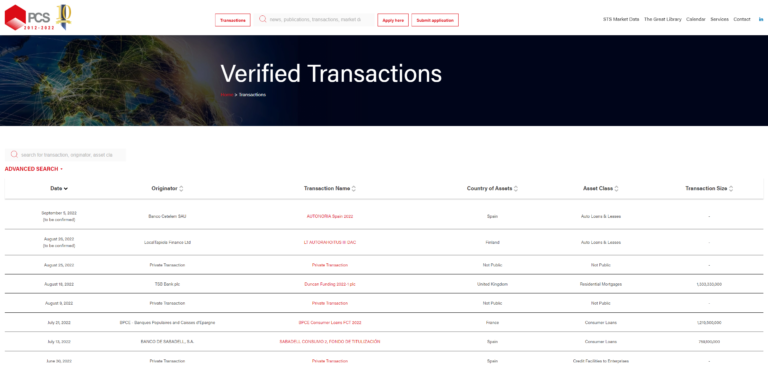

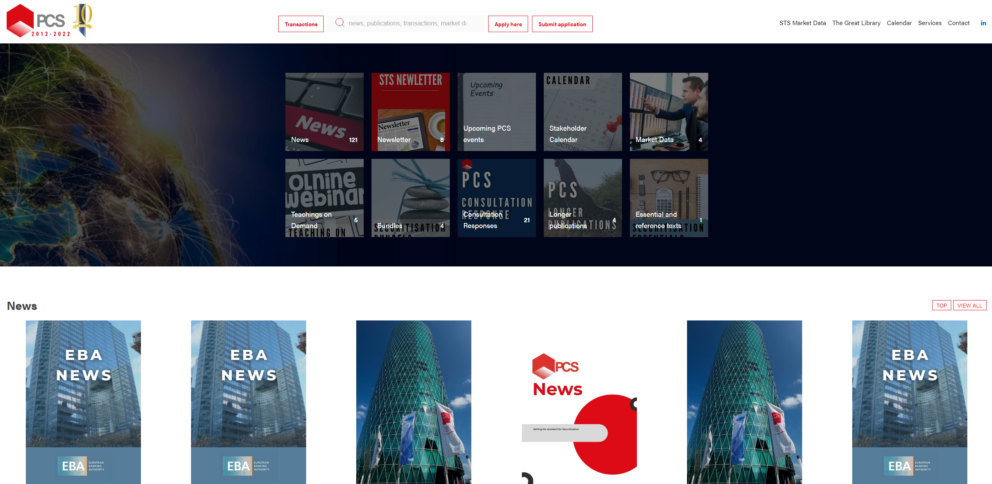

PCS is excited to announce that today its new website had gone live: www.pcsmarket.org (same place as before, so no need to update those bookmarks).

Our website has not just been updated but entirely recreated with a cornucopia of new functionality and up to date information on the European securitisation market. We strongly encourage you to take a tour through the new site and see how much of the information you always wanted to have in an easily readable format in an easily accessible place you can now find there.

For investors and market watchers, we have a much-improved search engine for PCS verified transactions. As before, you can find not only the PCS STS Checklists here but also the prospectus and key data on any PCS verified transaction.

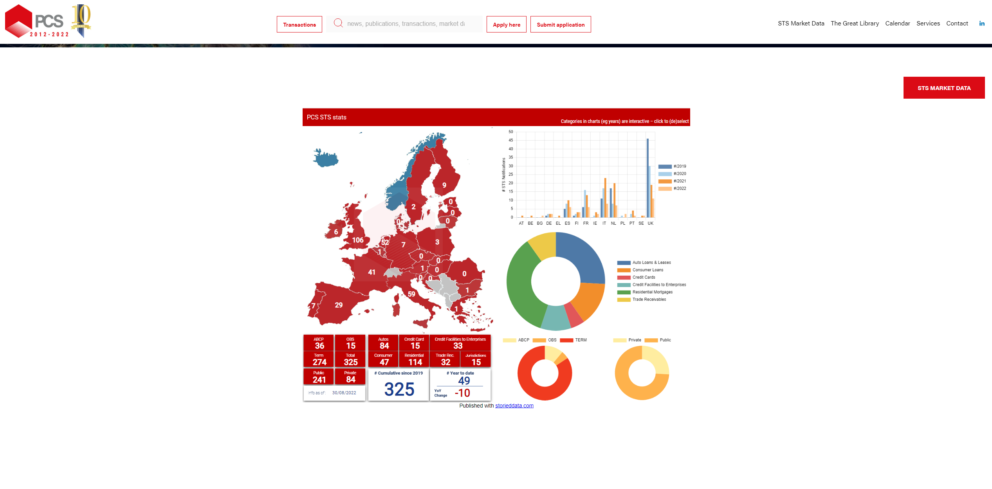

For those who are looking for up-to-date market data on STS securitisations, our new Market Data section allows you to search by country, year and asset class whether you are seeking a better understanding of the underlying trends or just trying to win a bet or confirm a hunch (and if your interest is more focused on PCS, our PCS Data section is there for you).

For those just starting in securitisation or curious about specific aspects, you can access the PCS Great Library where you can find:

- specially curated “bundles” of documents to get you started on a topic

- PCS webinars and presentations you may have missed or some you did not miss but would love to have another look at that interesting slide

- Longer texts not only from PCS but other market participants

- PCS consultation Responses

The Great Library is there to help you become an expert.

That is not all the Great Library contains. For hardened specialists, our Essentials section contains all up-to-date key legislative and regulatory texts you will no longer need to hunt out on less than helpful official search engines.

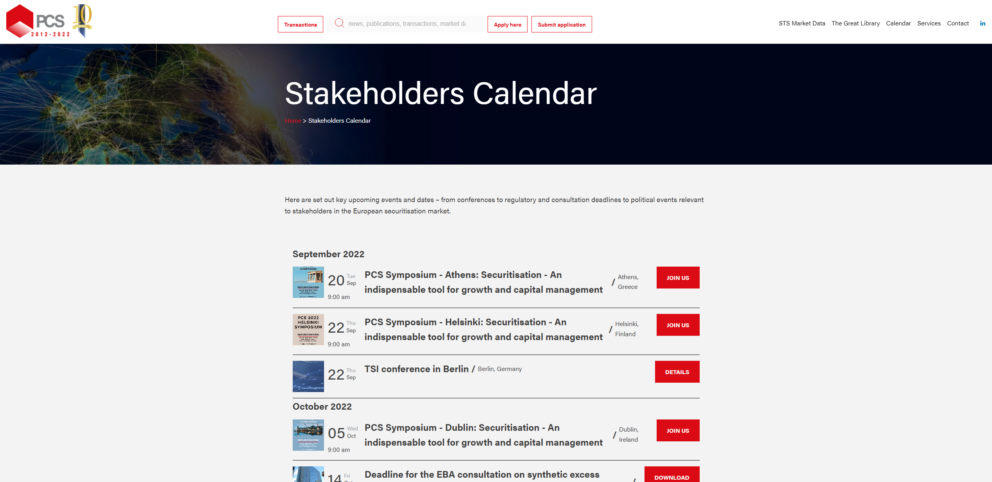

For all stakeholders wanting to plan the next few months or who have forgotten when responses are due on that consultation or a vote is taking place on that new regulation or just when exactly they have to book that tapas bar in Barcelona, we have a new Calendar setting out all the important dates for the securitisation market. Bookmark it and never miss another important event.

Finally, you can easily find out more details about upcoming PCS events.

In designing the new PCS website, we have not only sought to redesign the front end of a STS verification business. In line with our mission to revitalise the European securitisation market, we have tried to make our site the indispensable bookmark for anyone interested and/or active in our markets.

EBA publishes consultation on synthetic excess spread

The European Banking Authority has just launched a consultation on the treatment of "synthetic excess spread" or "SES".

The issue of the capital treatment of synthetic excess spread in the context of synthetic STS securitisation is a topic that is as arcane as it is important.

We will not review here the arguments and possible approaches as this would take way more space that is appropriate for a news item. To summarise, though, in a synthetic securitisation the originator and the investor can agree to an amount which will be deducted from any losses suffered on the securitised pool before the investor is required to make a protection payment. This is designed to replicate synthetically the effect of "excess spread" in a cash deal, where a lender does not suffer real cash losses if the interest paid on performing assets is sufficient to compensate for losses on the defaulting assets. Since this amount is just an agreed number (rather than, as in a cash deal, the actual cash received from borrowers) it is called "synthetic excess spread".

Synthetic excess spread is controversial and viewed with suspicion by regulators as it can, in theory, be used to generate regulatory arbitrage.

During the passage of the amendment to the Securitisation Regulation that ushered in synthetic STS, some voices were raised advocating the banning of any use of SES in STS synthetic transactions. Many, including PCS, argued that this was unnecessary and illogical since the device, properly deployed, only replicated synthetically a totally uncontroversial aspect of true sale securitisation. The compromise chosen by the legislators was to allow it but impose a capital cost on its use. We expressed the view at the time that this was the wrong answer and that a perfectly good answer had been suggested by the EBA itself in its original report which we were happy to endorse. But there we are.

Having chosen the solution of a capital cost for the SES, the legislators then left it to the EBA to come up with an amount. This consultation, deadline 14 October, solicits the market's views on the proposed EBA approach to calculating that amount. PCS will, of course, be responding.

EBA publishes consultation on updated homogeneity

The European Banking Authority has just launched a consultation on the homogeneity of the underlying exposures in STS securitisation.

The consultation is addressing the issue of the homogeneity in the context of synthetic STS securitisation. Although the scope is extended to also cover on-balance-sheet (synthetic) securitisations, at the same time it establishes the same criteria for the assessment of homogeneity for all securitisations.

More specifically, given the relevance of corporate and SME loans in the context of synthetic securitisations, adjustments have been made to the type of obligor to reflect the current market practices and the credit risk assessment approaches applied to those asset types.

At the same time the in the proposal, we see that similar changes are made to the respective homogeneity factor for all relevant asset types. The proposal further specifies the asset type for credit facilities provided to enterprises, where similar underwriting standards are applied as for individuals.

This consultation, deadline 28 October, solicits the market's views on the proposed EBA approach. PCS will, of course, be responding.

PCS files its response to EIOPA’s consultation

PCS filed its response to EIOPA’s disappointing consultation on a possible reform of the capital requirements for insurance companies investing in securitisations.

The response may be found here.

The consultation was, in our view, a major disappointment. EIOPA’s preliminary conclusions – underlined by their statements at a public roundtable attended by PCS – were that the current framework was “fit for purpose”.

For all the reasons set out in our response, PCS feels that this is not borne out by the facts and that the assertion itself as set out in EIOPA’s consultation document feels more like an “act of faith” than a genuinely reasoned conclusion.

We hope that the responses provided by stakeholders will lead EIOPA to reconsider the importance of fixing a framework that is unfair, inaccurate, and deeply damaging to the prospects of the European economy as well as a source of potentially destabilising regulatory arbitrage.

PCS responds to the Joint-Committee's Consultation on Sustainable Disclosure for STS

PCS has responded to the Joint-Committee of the European Supervisory Authorities on its consultation regarding the optional disclosure relating to sustainability of the assets securitised through an STS transaction.

Our response can be read here.

Acknowledging the very narrow mandate that had been given the Joint-Committee and the challenges this posed, PCS nevertheless believes that this was the wrong mandate, at the wrong time for far too narrow a sub-set of capital market instruments. Through no fault of the committee, this feels like another siloed regulatory endeavour that risks again punishing unnecessarily securitisation and tilting yet further an already unlevel playing field away from allowing securitisation to recover and play a full role in financing the transition to a sustainable economy.

To understand our approach, we invite you to read only the General Considerations section of our response. It covers merely three pages. (Although hard core players are welcome to read the full thirteen page document, of course.)

The Cinderella Regulation - EIOPA launches a consultation on Solvency II capital

We have previously referred to the issue of capital calibration for securitisations purchased by insurance undertaking as the "Cinderella issue". Of all the issues on which the European Commission has asked the ESA's to provide advice, it is both the least noticed and yet, in our view, the most important of the unfinished reforms begun with the passing of the Securitisation Regulation.

Today, insurance companies are holding a minuscule percentage of securitisations in their books - just above 2%. Their holdings of high quality STS securitisations are in homeopathic amounts at around 0.05%. Yet, if we are to see a revival of a securitisation market in Europe that mobilises non-bank savings to fund the economy, the return of insurance companies is essential.

Yesterday, EIOPA, as part of gathering evidence for its report to the commission, issued a consultation (here)

PCS welcomes this consultation and urges all concerned stakeholders to participate. We note though with some disappointment the very short period in which the market is asked to respond . The deadline for responses is 13 July. Less than four weeks in the summer months for a consultation likely to be heavy on data that needs to be gathered and marshalled seems unnecessarily challenging.

EBA publishes excellent report of "Green Securitisation"

Today the European Banking Authority released its Report on Developing a Framework for Sustainable Securitisation. This report was requested by the co-legislators who asked the EBA to outline how they would envisage a regime for green securitisation.

Although PCS still has to review the report in detail, a first look suggests that the EBA should be commended for the logical, coherent and fair approach it has brought to bear of this subject.

First, the EBA has concluded that there is no need or rationale for having a conceptually different approach to the definition and regulation of green securitisations from that of capital market instruments generally. PCS had expressed a concern over the asynchronicity of the work on green securitisation and the work of green capital market instruments in general in the context of the legislative passage of the EU Green Bond Standard. Specifically the accidental request that the EBA define “green securitisations” as a sub-category of capital market instruments before the EU had settled on a definiton of “green capital market instruments” as a whole. The EBA wisely concluded that this made little sense and that securitisations should be regulated under the same conceptual umbrella as all other capital market instruments.

Secondly, flowing from the first point, the EBA has agreed that a green securitisation should be defined, like any other green bond, by the use made of the proceeds of the issuance rather than by the green nature of the securitised assets. PCS strongly approves of this approach as we have pointed out publicly that any other would lead to deeply illogical consequences and reduce the amount of financing to the green transition.

The EBA also suggests that this proceeds based approach might be a transitional one until we have greened the European economy. There is a lot to be said for this view.

Finally, the EBA has pointed out that there is a technical amendment required to the current draft of the EU Green Bond Standard legislative text to ensure that the proceeds the use of which defines a green securitisation are the proceeds in the hands of the originator and not the special purpose vehicle. The same point had been made by the ECB and a number of market participants (including PCS). This appears not to be a political issue but merely (if crucially) a matter of getting the drafting right.

On synthetic green securitisation and social securitisation (the "S" in "ESG"), the EBA suggests more work needs to be done. This seems reasonable to us at PCS.

This is a well thought through and excellent report that deserved to be a building block on the path to mobilising the securitisation market in financing the desperately needed ecological transition