Welcome to this edition of the STS Newsletter by PCS keeping stakeholders up to date about market and regulatory developments in the world of STS.

In this edition, in our regular features, we share updated data on the STS securitisation market and present Rob Koning, a member of our Outreach Team.

In addition to those regular features, we have an update about the state of play regarding the upcoming new regulation on synthetic STS transactions.

As ever, we very much welcome any feedback on this Newsletter.

In this edition, we have not included the usual pie charts for STS transactions ytd, as these currently stand at 9 and 3 notifications to ESMA and the FCA respectively. These small numbers would make for pie charts with little added value. In our next Newsletter we will provide charts again.

As they had promised, ESMA sifted the UK transactions from their list. Although they still appear in the ESMA list, they are marked “cancelled”. ESMA also provided a separate spreadsheet setting out all the cancelled UK transactions which can be found on the relevant page of their website. So anyone wanting to check whether a given UK securitisation is still STS can look it up on this list. (Hint: it will not be).

The last time we broached the subject of the proposed synthetic STS legislation was in our mid-December end-of-year Newsletter.

We were still awaiting with some trepidation the publication of the final political compromise between the European Parliament and the Member States. This occurred on December 16th, almost immediately after the publication of our Newsletter.

That final compromise brought both some relief and some disappointment. The relief was that most of the difficult issues around which some potentially damaging proposals had been floated ended up in (mostly) the right place. The disappointment came from the timetable. Whereas we and many market participants had expressed the hope that STS for synthetics would be able to come into force in the first quarter of 2021, the calendar slipped, although not dramatically. Also, considering the generous grandfathering provisions of the draft law, this slippage may have only limited consequences.

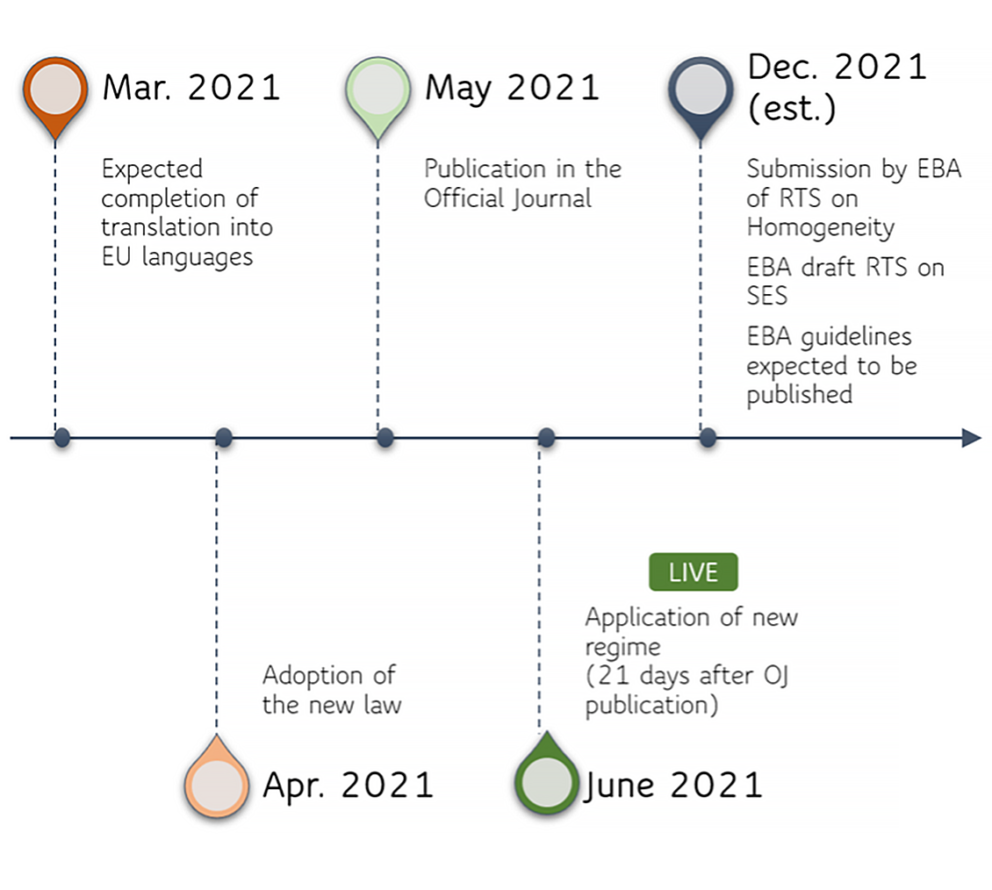

Despite, arguably optimistic, predictions of an entry into force of the new STS regulation by the middle of the first quarter, it now seems likely that the law will only be on the books around May/June of 2021.

As you can see, the current forecast is for the law to be voted by the European Parliament in March (with the 8th March Plenary Session the current favorite for the vote). Of course, a potentially heavy COVID driven agenda could result in delays either for the Parliamentary or the Member States’ vote.

The diagram also refers to the EBA RTS drafts, of which more below.

The final legislative text does not fundamentally change the approach to the new synthetic STS category.

The first point that we would like to stress is that the new synthetic STS criteria are not simple. PCS has now replicated its STS true sale checklist for the new synthetic criteria, breaking down the complex legislative language into the smallest binary, yes/no, questions that have to be answered to confirm a synthetic transactions’ STS status.

For the existing true sale STS rules, this stands at 103 separate criteria, all of which must be met. For the new synthetic STS rules, that number stands at 145 to 160!

During the political negotiations four issues had arisen around which a number of proposals had been floated, which – had they been included in the final text – would have severely (and potentially terminally) affected the possibility for any originator/protection buyer to issue a synthetic STS securitisation. Mostly, these were positively resolved in the final agreement.

Overall, therefore, the most threatening pressure points appear to have been resolved in a satisfactory manner. A cloud though still hangs over those synthetic transactions which need to use SES and we will await the EBA’s proposals with some trepidation.

In addition to amendments to the STS Regulation, amendments are being made to the Capital Requirements Regulation to allow lower capital allocations to the senior tranches of synthetic securitisations achieving STS. (For a fuller discussion of why this is important, we invite you to read our article “Synthetic STS – Quo Vadis?” in our December Newsletter.

The agreed legislative draft effectively replaces the current Article 270. This article was an exception to the principle that synthetic securitisations could not benefit from the lower capital requirements allowed to true sale STS securitisations. This exception was limited however to certain SME backed transactions.

The new rules would allow any synthetic transaction that met the STS criteria (subject to our note below) to get the benefit of these lower capital requirements. In other words, Article 270 is now extended to all asset classes (save for NPLs).

A word of warning though. In the existing CRR rules for true sale STS securitisation it is not sufficient that a transaction be STS to benefit from the lower capital requirements. Additional criteria above and beyond STS also need to be met. These criteria when added to the other STS criteria are sometimes referred to, by market participants, as STS+. (Incidentally, they are also the subject matter of PCS’ CRR Assessment which is often sought in addition to PCS’ STS Verification.)This requirement for additional criteria is maintained for synthetics seeking lower capital requirements under the proposed new rules. STS+ will remain relevant. (Helpfully, PCS intends to offer its CRR Assessment for synthetic transactions).

As mentioned above, the political compromise around SES requires the EBA to provide a draft regulatory technical standard (RTS) which will define an amount of capital that a bank using SES in a synthetic securitisation will need to allocate against that SES.

Setting aside the puzzling notion that a bank needs to set aside capital for a non-balance sheet revenue stream rather than an asset, it is unclear at this stage how this additional capital will be calculated. Depending on the outcome of the EBA’s work, it could well be that few, if any, synthetic securitisations using SES could be profitably issued. This therefore casts a shadow over securitisations intending to use SES and we look forward to the EBA providing some swift guidance as to their thinking.

The good news is that grandfathering under the proposed legislation is easy.

All that is required for a synthetic securitisation issued prior to the entry into force of the new law to become STS is for that transaction to meet the STS requirement at the time of notification to ESMA.

The likelihood of the current draft not being voted or being amended by the Parliament in plenary is extremely small. Therefore, it should be possible for banks to structure and issue synthetic securitisation right now with a fairly high expectations that these will be able to benefit from lower capital requirements by the second half of the year. No need to wait.

To avoid existing Article 270 SME securitisations legitimately issued since January 2019 losing the benefit of the lower capital requirements because of the addition of new criteria for synthetic STS, the proposed law sensibly grants automatic grandfathering to all those transactions. They will continue to remain eligible notwithstanding that they do not necessarily meet all the new criteria.

The new synthetic STS proposals retain the role of independent, regulated third party verification agents on the same basis as for true sale STS securitisations.

PCS has already stated that it will perform this role for this new market sector once the law has passed.

Because, as we have seen, it is possible for banks immediately to structure and issue synthetic securitisations with a high level of confidence that these will attract the lower capital requirements for senior tranches by year-end, PCS is also immediately able to provide a two-stage verification service. In the first stage, PCS will provide, at or before closing, a preliminary checklist covering all the proposed synthetic STS criteria (and, if requested, the STS+ additional criteria). In the second stage, which will fall after the entry into force of the law, PCS will complete its verification and issue its final checklist.

For more details, please visit our website page.

The new law, quite obviously, only applies to EU member states. Currently, PCS is not aware of any legislative proposal in the United Kingdom that would introduce a similar regime. Therefore, none of this applies to UK securitisations.

PCS regularly askes stakeholders what changes and improvements they would like to see in our reporting format. Following the latest request for feedback, PCS has implemented an improved reporting format. The new format of our STS Verification Checklist can be viewed at this page.

PCS is a compact organisation with a total staff of 12.

In each Newsletter we will introduce one of them so that people get to know us. This time, Rob Koning, Issuer Liaison in the Outreach Team.

Rob Leach

After a start in banking as relationship manager at Amro Bank, later merged into ABN AMRO, I switched in 1994 to the relatively new and unknown securitisation product. After a few years of struggling to survive for my department, the growth of the securitisation business gained traction in the late 90’s and so did my business line. Until 2008 I have been running the global ABCP business of the bank, first based in Chicago and later in Amsterdam. In 2008, the securitisation activities of ABN AMRO were acquired by RBS and I continued my work in the securitisation industry as an independent consultant.

After a period at Rabobank, I was invited in 2012 to become the first Director of the Dutch Securitisation Association and in 2018 I also joined PCS as liaison for originators, arrangers and issuers.

I am married and father of 5 and grandfather of 6 and live in the place I was born, Amsterdam, in an apartment near the river Amstel. In my spare time, I like hiking and biking in my hometown and the surrounding countryside.

Created by Proformat